More on the bifurcation between the booming stock market and the bust of an economy I wrote that new stock market highs in the face of the worst US economic downturn since the Great Depression were primarily a function of a few stocks that are particularly tied to the global economy rather than tethered to the US; that those stocks also benefited from delivering online content or physical stuff to homebound consumers; and that the background long leading indicators favor an expanding economy once the pandemic is behind us. In addition to Paul Krugman, here are two more commentators who have weighed in on the issue, making much the same points as I did. Barry Ritholtz: “[I]t’s not rare for a small group of stocks to account for a large percentage of

Topics:

NewDealdemocrat considers the following as important: Featured Stories, US/Global Economics

This could be interesting, too:

Ken Melvin writes A Developed Taste

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

More on the bifurcation between the booming stock market and the bust of an economy

I wrote that new stock market highs in the face of the worst US economic downturn since the Great Depression were primarily a function of a few stocks that are particularly tied to the global economy rather than tethered to the US; that those stocks also benefited from delivering online content or physical stuff to homebound consumers; and that the background long leading indicators favor an expanding economy once the pandemic is behind us.

In addition to Paul Krugman, here are two more commentators who have weighed in on the issue, making much the same points as I did.

“[I]t’s not rare for a small group of stocks to account for a large percentage of the S&P 500. What is important is the relative performance of those 10 stocks to the other 490 stocks. The ratio fluctuates based on which group is outperforming, resulting in a continuous battle between mega cap stocks and the merely large and mid-sized stocks.

“What makes 2020 so unique is the externality of the pandemic and societal-wide lockdown. The economic impact hasn’t been evenly distributed. Large international tech companies essential to remote office work and people stuck in their houses have thrived. Add to that how much better the rest of the world has managed its response to the pandemic versus the U.S.’s bungled response. One would be hard pressed to find another era when circumstances led these two groups of companies to diverge as much as they have of late.”

Ritholtz links to an earlier piece from about a month ago:

“Yet, maybe tech isn’t all that dependent on growth in the U.S. Compared to the rest of the world, and for the first time in ages, many wealthy industrialized countries are doing better — and in some cases, much better — than the U.S. Nations such as Japan, South Korea and Germany not only have managed to contain the pandemic, but their economies are well ahead of the U.S.’s into their re-openings.“For the past five years, a small group of tech stocks has had an outsized influence on U.S. markets. Two-thirds of the gains in the S&P 500 have been driven by just six U.S. companies — Facebook, Amazon, Apple, Netflix, Google (Alphabet) — the so-called FAANG stocks — and Microsoft. An index of those six stocks is up more than 62% since the March lows, while the S&P 5001 is up about 40%:

“Overseas markets may very well be a key reason shares of the biggest U.S. tech companies are powering higher. These tech companies derive a surprisingly large share of their revenue from foreign markets. According to Standard & Poor’s, companies in the S&P 500 derived 42.9% of their sales from overseas markets in 2018 (2019 data is not yet available).

“But this share is much higher for the big tech companies: Apple generated more that 55% of its revenue outside the U.S. in the year ended in September; in some quarters, overseas accounted for as much as 60% of revenue. International accounted for 54.5% and 53.8% of Facebook and Alphabet revenues, respectively. For Microsoft and Netflix, the split is about half domestic and half overseas (49.0% and 49.4%, respectively). Amazon is the Big Tech exception, generating a sizable majority of its revenue within the U.S.

“It isn’t a coincidence that these companies that are so reliant on the rest of the globe have seen their stock prices do well. The Covid-19 numbers suggest that much of the world is way ahead of the U.S. not only in terms of managing the pandemics, and that their economies are recovering faster.”

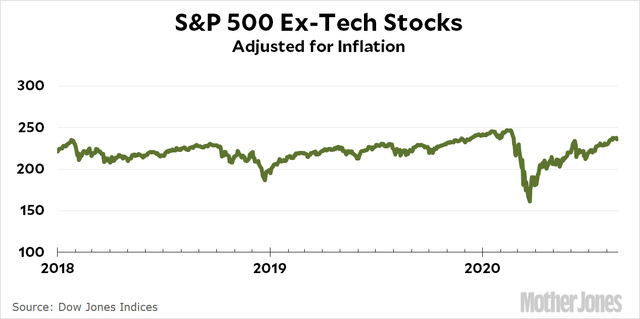

“This is an S&P 500 index with tech stocks removed and adjusted for inflation. You can see two things. First, over the past three years it’s not very impressive. Second, it plunged in March thanks to COVID-19 and has never recovered completely.

“(And that’s even though this index includes powerhouses like Amazon, Google, and Facebook, none of which are categorized as “information technology.”)

“You can always remove the top performer from a broad stock index and produce a weaker looking trend. Still, this is more dramatic than usual. This isn’t just weaker looking, it’s practically flat. The collective performance of literally everything in the United States is kind of dismal except for companies like Microsoft, Apple, and Oracle.

“So when someone asks why the stock market is doing so great even though we’re in the middle of a massive pandemic, this is part of the answer: it’s not doing so great. Aside from tech stocks, the market has been ho-hum over the past few years and is still down 4 percent from its pre-pandemic level. Investors obviously have some confidence that the economy will rebound once we approve a vaccine and the pandemic is finally sidelined—as they should—but they’re hardly being cheerleaders for the overall economy. They just like tech stocks.”