Initial jobless claims decline further, but continuing claims fail to make meaningful progress – by New Deal democrat Weekly initial and continuing jobless claims give us the most up-to-date snapshot of the continuing economic impacts of the coronavirus to the average worker. Twelve weeks after calamity first struck, the theme remains “less awful.” First, here are initial jobless claims both seasonally adjusted (blue) and non- seasonally adjusted (red). The non-seasonally adjusted number is of added importance since seasonal adjustments should not have more than a trivial effect on the huge real numbers: There were 1.542 million new claims , which after the seasonal adjustment became 1.537 million. This is a -355,000 decline from last week’s number,

Topics:

NewDealdemocrat considers the following as important: US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Initial jobless claims decline further, but continuing claims fail to make meaningful progress

– by New Deal democrat

Weekly initial and continuing jobless claims give us the most up-to-date snapshot of the continuing economic impacts of the coronavirus to the average worker. Twelve weeks after calamity first struck, the theme remains “less awful.”

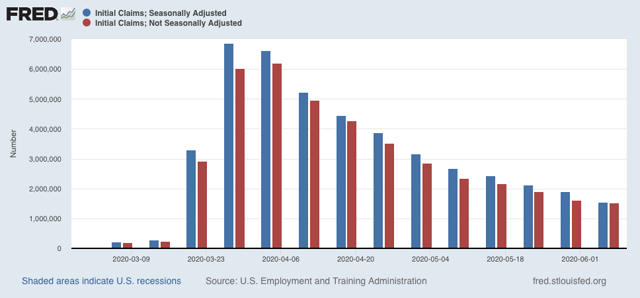

First, here are initial jobless claims both seasonally adjusted (blue) and non- seasonally adjusted (red). The non-seasonally adjusted number is of added importance since seasonal adjustments should not have more than a trivial effect on the huge real numbers:

There were 1.542 million new claims , which after the seasonal adjustment became 1.537 million. This is a -355,000 decline from last week’s number, and the lowest so far since the virus struck – but still almost twice as bad as the worst week during the “Great Recession.”Since we are more than a month after some States “reopened,” these new claims primarily represent spreading second-order impacts.

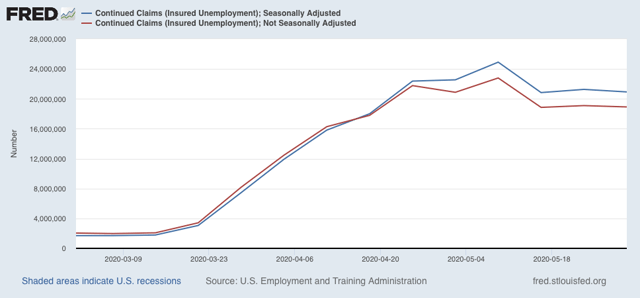

Unfortunately, the “less bad” trend has not continued in continuing claims, which lag one week behind. In the past three weeks, both the non-seasonally adjusted number (red), and the less important seasonally adjusted number (blue) have remained nearly stationary. This week the former declined by 339,000 to 20.929 million, but was 88,000 above the 20.841 reading of two weeks ago; while the latter declined by 179,000 to 18.920 million, 58,000 above its 18.861 reading two weeks ago:

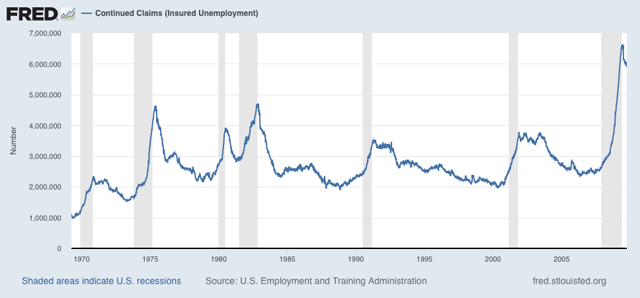

On a more long-term note, historically continuing claims have peaked at the end of or just after the end of recessions. Here’s the graph showing that from the beginning of the series through 2009:

Depending on what happens with the King of Coincident Indicators, industrial production, when it is reported next week, it is possible that the NBER could call an end to a very short recession. But since the virus has not gone away, and indeed new cases are increasing again, I suspect we may see renewed restrictions implemented in many parts of the country in the next few months.