Real wages declined slightly in Q4 2019; nearly flat since last January In December consumer inflation was +0.2%. Since in last Friday’s jobs report average hourly earnings also increased +0.1%, real average hourly earnings declined slightly: In a longer term perspective, this means that real wages also declined from 97.8% to 97.5% of their all time high in January 1973: The YoY measure of real average wages also declined sharply from +1.6% to +0.7%: [Note however that this is subject to the same quirks as I discussed yesterday in terms of YoY nominal wage growth for December, so a rebound in January would hardly be a surprise] Aggregate hours and payrolls improved significantly between July and September, but have declined slightly in the three

Topics:

NewDealdemocrat considers the following as important: US/Global Economics, wage growth

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

Real wages declined slightly in Q4 2019; nearly flat since last January

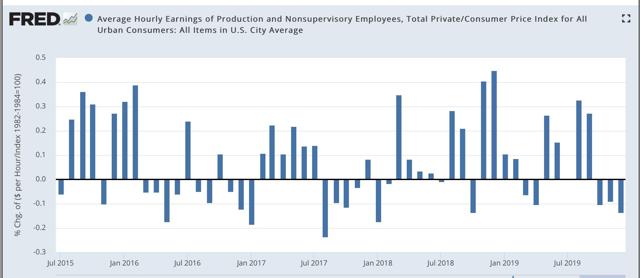

In December consumer inflation was +0.2%. Since in last Friday’s jobs report average hourly earnings also increased +0.1%, real average hourly earnings declined slightly:

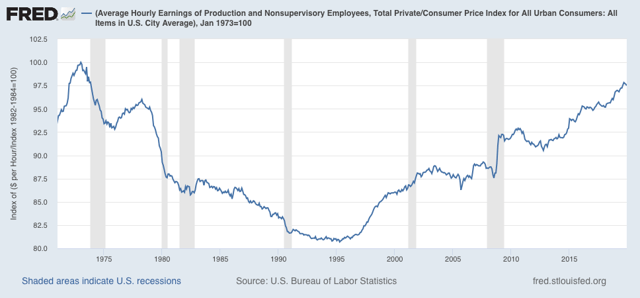

In a longer term perspective, this means that real wages also declined from 97.8% to 97.5% of their all time high in January 1973:

The YoY measure of real average wages also declined sharply from +1.6% to +0.7%:

[Note however that this is subject to the same quirks as I discussed yesterday in terms of YoY nominal wage growth for December, so a rebound in January would hardly be a surprise]

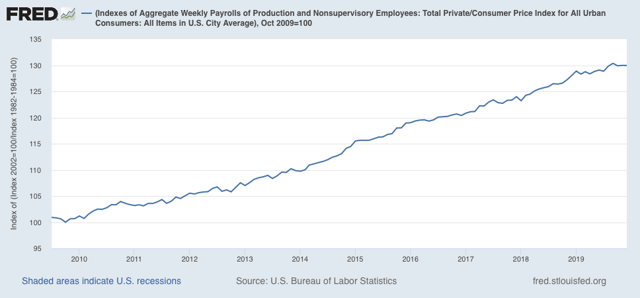

Aggregate hours and payrolls improved significantly between July and September, but have declined slightly in the three months since, so real aggregate wages – the total amount of real pay taken home by the middle and working classes – have declined from 30.4% to 30.0% above their October 2009 trough at the beginning of this expansion:

Real aggregate wage gains have only been +0.8% in the past 11 months. As with so much other data, this is on the cusp of warranting at least a yellow flag. I’ll have more to say once retail sales are reported later this week.