With a Booming economy comes at least transitory inflation: March producer prices One of the economic subjects you are going to hear a lot about this year is inflation. We are recovering from a sharp if brief recession, and with the dual firehoses of fiscal and monetary stimulus, entering a Boom such as we have probably not seen in over 50 years. Unsurprisingly supplies of commodities and goods that had been cut back during the recession are going to be stretched thin and much competed for now, generating at least a brief burst of inflation. With that background noted, this morning producer prices for March were reported up 1.3% for that month alone. YoY producer prices are up 6.0% (blue in the graphs below): Much of the increase

Topics:

NewDealdemocrat considers the following as important: booming economy, infltion, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

With a Booming economy comes at least transitory inflation: March producer prices

One of the economic subjects you are going to hear a lot about this year is inflation. We are recovering from a sharp if brief recession, and with the dual firehoses of fiscal and monetary stimulus, entering a Boom such as we have probably not seen in over 50 years.

Unsurprisingly supplies of commodities and goods that had been cut back during the recession are going to be stretched thin and much competed for now, generating at least a brief burst of inflation.

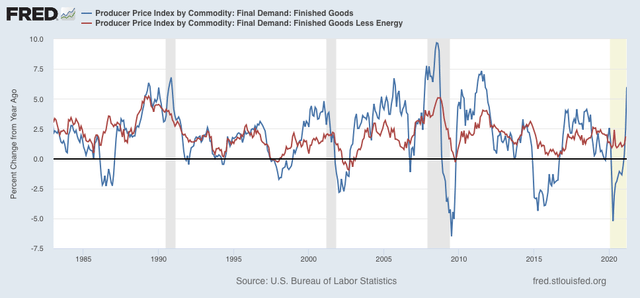

With that background noted, this morning producer prices for March were reported up 1.3% for that month alone. YoY producer prices are up 6.0% (blue in the graphs below):

Much of the increase has been due to gasoline. Take out energy costs and producer prices were up a more modest 3.3% (red in the graph above).

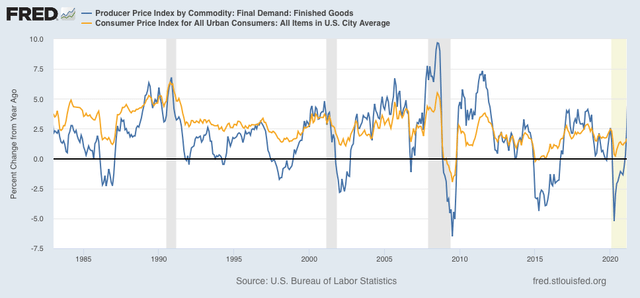

Typically producer and consumer prices move in sync, with no more than one month’s variation in YoY peaks and troughs. But consumer prices are much less volatile (gold in the graph below):

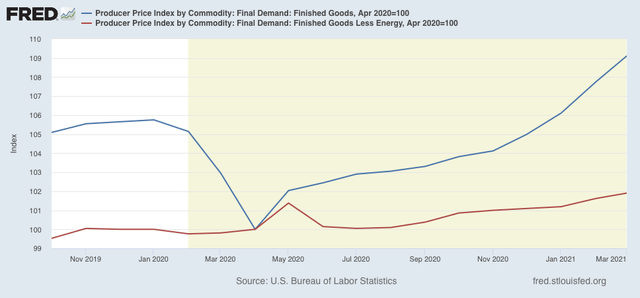

Because producer prices frequently actually decline during a recession, as they did in March and April of last year, it is not a surprise that some of their biggest YoY increases occur right thereafter, as recessionary price declines are replaced by strong gains due to increased demand:

And that’s what is happening now.

I am expecting inflation to abate next year after a great deal of caterwauling from Doomers this year. One negative this year, however, will likely be that average wages will not keep up, resulting in an actual decline in purchasing power for many ordinary workers.