Jobless claims: progress pauses, as a new surge in COVID in Michigan and the Northeast causes concern New jobless claims are likely to the most important weekly economic data for the next 3 to 6 months. As the number of those vaccinated continues to increase, I expect a big increase in renewed consumer and social activities, with a concomitant gain in monthly employment gains – as we saw in the March jobs report last week.Three weeks ago I set a few objective targets: I am looking for new claims to be under 500,000 by Memorial Day, and below 400,000 by Labor Day. This week didn’t help us, although it is more of a pause than a significant increase. On a unadjusted basis, new jobless claims rose by 18,172 to 740,787. Seasonally adjusted claims

Topics:

NewDealdemocrat considers the following as important: jobless claims, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Jobless claims: progress pauses, as a new surge in COVID in Michigan and the Northeast causes concern

New jobless claims are likely to the most important weekly economic data for the next 3 to 6 months. As the number of those vaccinated continues to increase, I expect a big increase in renewed consumer and social activities, with a concomitant gain in monthly employment gains – as we saw in the March jobs report last week.Three weeks ago I set a few objective targets: I am looking for new claims to be under 500,000 by Memorial Day, and below 400,000 by Labor Day. This week didn’t help us, although it is more of a pause than a significant increase.

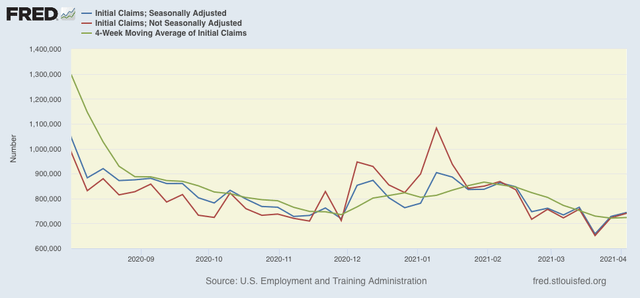

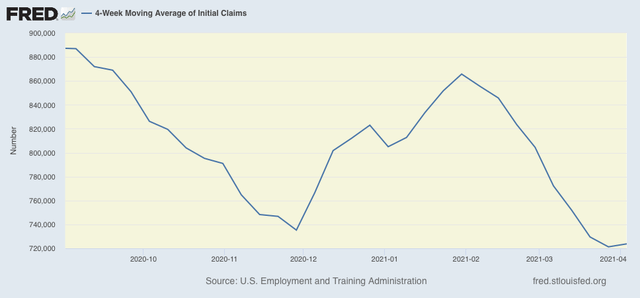

On a unadjusted basis, new jobless claims rose by 18,172 to 740,787. Seasonally adjusted claims rose by 16,000 to 744,000. The 4 week average of claims also rose by 2,000 from last week’s pandemic low of 721,250 to 723,250.

Here is the close up since last August (recall that these numbers were in the range of 5 to 7 million at their worst in early April):

Focusing just on the less volatile 4 week average since September shows that the last several weeks have been more of a pause at the recent low rather than a notable reversal:

Note that I have discontinued the YoY comparisons since we would be comparing against the very worst weeks of the initial lockdowns last year.

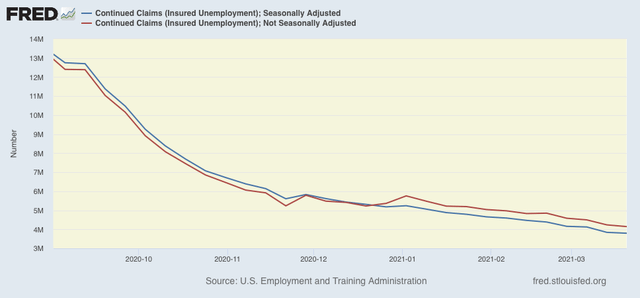

Continuing claims, which historically lag initial claims by a few weeks to several months, continued to make new pandemic lows yet again this week. Seasonally adjusted continuing claims declined by 16,000 to 3,734,000, while the unadjusted number declined by 67,666 to 4,031,531:

Seasonally adjusted continued claims have now slowly declined to levels last seen in the summer of 2011, when weekly jobless claims were just over 400,000 and the unemployment rate was 8.2%.

I remain bullish that the ever-increasing pool of fully vaccinated adults – 64,300,000 as of yesterday, or almost 25% of the entire adult population – together with the ongoing seasonal shift from indoor to outdoor activities, is going to continue to result in a dramatic fall in jobless claims over the next few months.

I have to acknowledge, however, that I am growing more concerned at the big spike in new coronavirus cases from the now-dominant UK variant in Michigan and the Northeast, which is now showing up in increased deaths as well. It is at least reasonably possible that this will entirely counterbalance progress on the vaccine front for the next 2 to 3 months.