February personal income and spending decline: the back end of January stimulus payments Last month I wrote that the:“report on January personal income and spending shows just how important the stimulus packages enacted by the federal government both last spring and last month have been to sustaining the economy.”The truth of that was confirmed on the back end in this morning’s report for February, in which January’s 10% increase in income was followed by a -7.1% decrease (red). January’s increase of 3.4% in spending was also partially reversed by a -1.0% decrease in February (blue): In its release, the Census Bureau confirmed this analysis, writing: “The decrease in personal income in February was more than accounted for by a decrease in

Topics:

NewDealdemocrat considers the following as important: personal income, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

February personal income and spending decline: the back end of January stimulus payments

Last month I wrote that the:

“report on January personal income and spending shows just how important the stimulus packages enacted by the federal government both last spring and last month have been to sustaining the economy.”

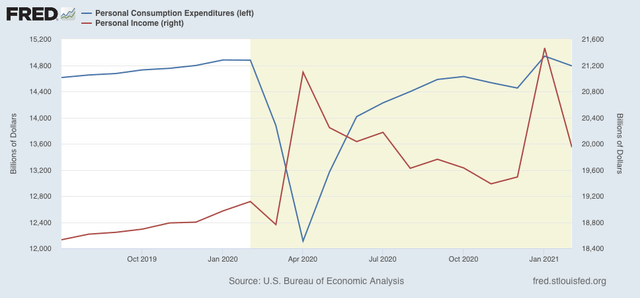

The truth of that was confirmed on the back end in this morning’s report for February, in which January’s 10% increase in income was followed by a -7.1% decrease (red). January’s increase of 3.4% in spending was also partially reversed by a -1.0% decrease in February (blue):

In its release, the Census Bureau confirmed this analysis, writing:

“The decrease in personal income in February was more than accounted for by a decrease in government social benefits to persons. Within government social benefits, ‘other’ social benefits, specifically the economic impact payments to households, decreased. The CRRSA Act authorized a round of direct economic impact payments that were mostly distributed in January.”

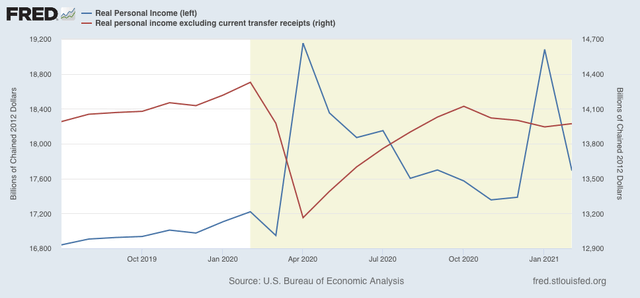

The importance of the stimulus is further shown dramatically when we subtract government transfer receipts from the equation, shown in red in the graph below:

Real personal income excluding government transfer receipts *rose* slightly in February.

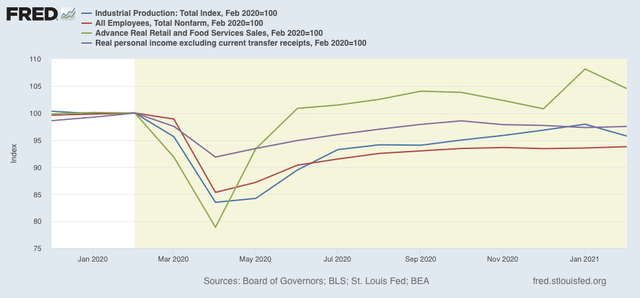

Since this last metric is the last of the four coincident metrics to be reported for February, we can now plot the general outline of the economy through last month, including production (blue), jobs (red), real retail sales (green), and real income (purple):

Employment is down over 5% since last February, while production is down 4%. Meanwhile, income is down only 2.5%, and real sales have actually increased by nearly 5%! Most recently, in the combined two-month period since December, two of the series – payrolls and real sales – have increased, while the other two – industrial production and income less government payments – have declined. Since the Big Texas Freeze impacted probably substantially impacted all of these, the underlying situation is presumably better.

Government aid has kept the pandemic from turning into a true economic disaster. Going forward, I expect improvement throughout spring into summer in all of this data.