A slow grind in new and continued claims as Covid’s effects gradually transition from pandemic to endemic Jobless claims declined 38,000 this week to 326,000, still 14,000 above the September 4 pandemic low of 312,000. The 4 week average rose 3,500 to 344,000, 8,250 above their September 18 pandemic low of 335,750: Continuing claims declined 97,000 to 2,714,000, a new pandemic low: Here is the YoY% change of continuing claims: Based on the YoY change, it appears that the ending of all of the emergency pandemic assistance programs has had very little effect on continuing claims, at least so far. With the Delta wave declining 40% from peak in the past month, the failure to make more downward progress in new claims is

Topics:

NewDealdemocrat considers the following as important: Healthcare, the transition from pandemic to endemic, US/Global Economics

This could be interesting, too:

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes How Tesla makes money

Joel Eissenberg writes RFK Jr. blames the victims

Angry Bear writes True pricing: effects on competition

A slow grind in new and continued claims as Covid’s effects gradually transition from pandemic to endemic

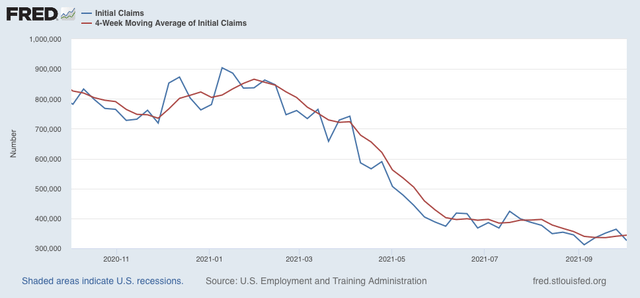

Jobless claims declined 38,000 this week to 326,000, still 14,000 above the September 4 pandemic low of 312,000. The 4 week average rose 3,500 to 344,000, 8,250 above their September 18 pandemic low of 335,750:

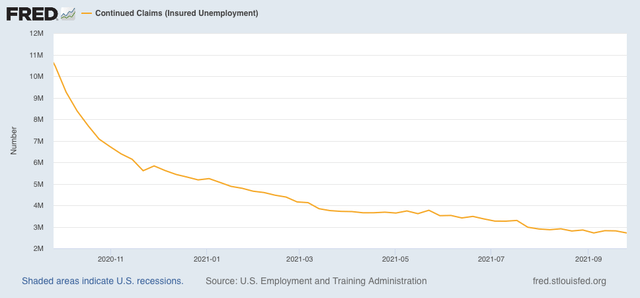

Continuing claims declined 97,000 to 2,714,000, a new pandemic low:

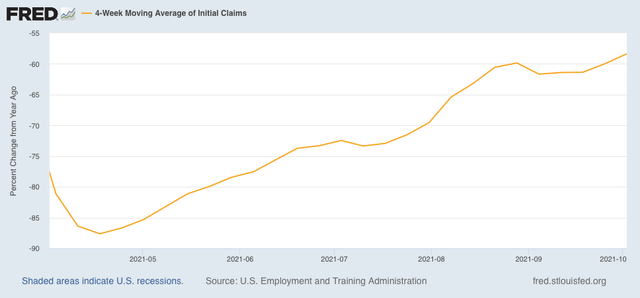

Here is the YoY% change of continuing claims:

Based on the YoY change, it appears that the ending of all of the emergency pandemic assistance programs has had very little effect on continuing claims, at least so far.

With the Delta wave declining 40% from peak in the past month, the failure to make more downward progress in new claims is not due to changes in the pandemic, but more likely reflective of an economy grinding ahead with continued issues both in supply bottlenecks and in consumer (and potential employee) wariness in engaging in many indoor or crowded activities.

In tomorrow’s jobs report, I will be paying particular attention to manufacturing, first in terms of average hours of work and secondly in changes in manufacturing payrolls themselves, to gauge whether supply bottleneck issues are affecting that leading sector. Whether retail jobs generally and leisure and entertainment jobs more specifically continue to improve is also going to be a focus.