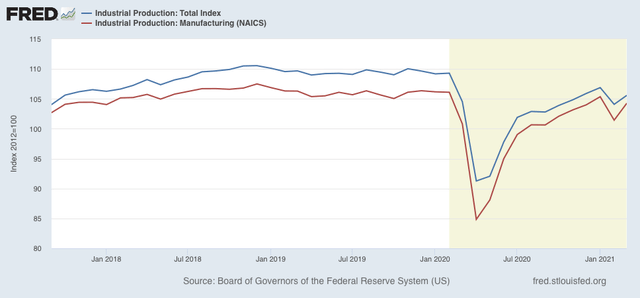

Industrial production for March disappoints – but only on the surface As an initial note, retail sales for March blew out to the upside, but as expected due to cosnumers’ spending their latest pandemic stimulus checks. This does have implications for future jobs reports, but I will report on that tomorrow. But to the main point . . . Industrial production rose in March, but disappointingly – on the surface at least – did not recover to its level in January, as shown below in the graph of total production (blue) and the manufacturing. component (red): But on closer examination, the reasons for the shortfall put an entirely different gloss on the numbers. First of all, one of the three components of production, besides manufacturing

Topics:

NewDealdemocrat considers the following as important: industrial production, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Industrial production for March disappoints – but only on the surface

As an initial note, retail sales for March blew out to the upside, but as expected due to cosnumers’ spending their latest pandemic stimulus checks. This does have implications for future jobs reports, but I will report on that tomorrow. But to the main point . . .

Industrial production rose in March, but disappointingly – on the surface at least – did not recover to its level in January, as shown below in the graph of total production (blue) and the manufacturing. component (red):

But on closer examination, the reasons for the shortfall put an entirely different gloss on the numbers.

First of all, one of the three components of production, besides manufacturing and mining, is utilities, as to which the Fed appended this note:

“The drop of 11.4 percent for utilities in March was the largest in the history of this index (since 1972).”

This was probably due to much fairer weather than expected during the month.

Further, as to manufacturing, the Fed noted:

“The output of motor vehicles and parts rose 2.8 percent in March after falling 10 percent in February. Shortages of semiconductors held down vehicle production in both months, while cold weather also curbed production in February.”

In other words, had it not been for a bottleneck in supply, industrial production would have rebounded much more sharply in March.

This is very bullish for production in the immediate future. I think we may see production all the way back at pre-pandemic levels by the end of summer.