We all expected inflation to arrive: now it’s here This morning’s report on April inflation confirmed what we already knew: inflation, both from the demand and the supply side, was coming. Now it’s here. First of all, take the YoY numbers with a grain of salt. Last April saw actual price declines in the teeth of the worst of the pandemic deaths and lockdowns. Here’s the monthly %change since the beginning of 2020 in total inflation (blue), core, i.e., less food and energy (red), and less energy only (gold): So let’s delete last April, and look at the price increases in the 11 months since last May: Total prices are up 4.3% since then, but only 3.0% in the “core” groups, and 2.8% less energy. That’s not enough to excite the Fed into

Topics:

NewDealdemocrat considers the following as important: inflation, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

We all expected inflation to arrive: now it’s here

This morning’s report on April inflation confirmed what we already knew: inflation, both from the demand and the supply side, was coming. Now it’s here.

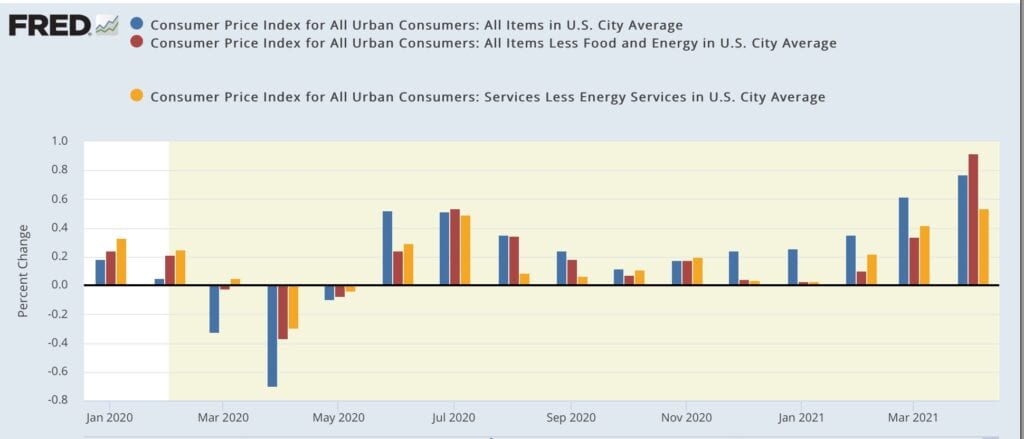

First of all, take the YoY numbers with a grain of salt. Last April saw actual price declines in the teeth of the worst of the pandemic deaths and lockdowns. Here’s the monthly %change since the beginning of 2020 in total inflation (blue), core, i.e., less food and energy (red), and less energy only (gold):

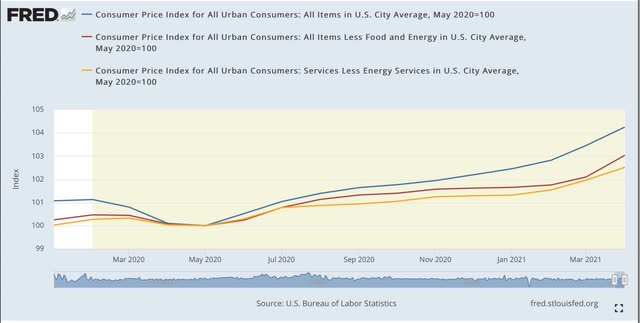

So let’s delete last April, and look at the price increases in the 11 months since last May:

Total prices are up 4.3% since then, but only 3.0% in the “core” groups, and 2.8% less energy. That’s not enough to excite the Fed into action just yet.

As I’ve previously pointed out, typically there’s no problem in the economy till CPI excluding gas prices exceeds 3%, and per the above, we’re not there yet.

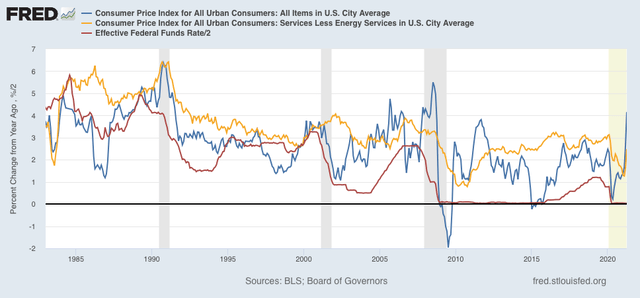

Further, below I show total inflation YoY (blue), inflation ex-gas (gold), and Fed funds rates (red, /2 for scale). As shown there, spikes in inflation for a month or two typically haven’t caused the Fed to raise rates (see, e.g., 1995, 2003, and 2013):

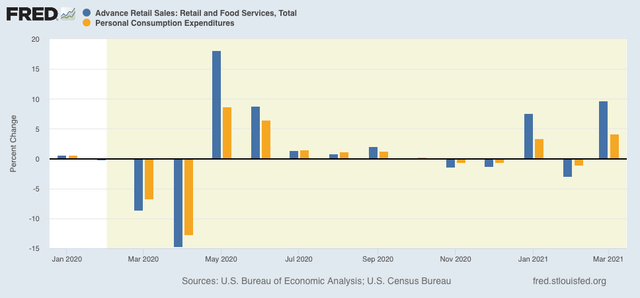

Last year, the demand-side effects on spending caused by stimulus payments petered out after a few months:

I expect the same to be the case this year.

So the question is whether the supply side bottlenecks persist enough to spook the Fed. While they might start making noises about raising rates if we get another number like this next month, I think it will take at least two more months of big jumps in prices to actually move them into action.