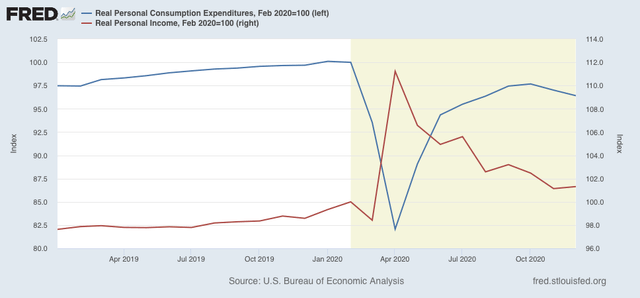

Real personal spending declines in December, while income rises; not quite enough to start a “double-dip” recession This morning’s report on personal income and spending for December reversed the pattern we have seen all during the second half of 2020. After rebounding strongly for 6 months, real personal spending (blue in the graph below) declined for the month by -0.2%, and is 3.6% below its February peak. Meanwhile real personal income (red), which has generally declined since April, rose 0.6%, and remains 1.3% higher than it was in February just before the pandemic hit: The continued strength in income compared with prior to the pandemic has everything to do with the emergency stimulus Congress put in place early on after the pandemic hit.

Topics:

NewDealdemocrat considers the following as important: personal income, real income, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Real personal spending declines in December, while income rises; not quite enough to start a “double-dip” recession

This morning’s report on personal income and spending for December reversed the pattern we have seen all during the second half of 2020. After rebounding strongly for 6 months, real personal spending (blue in the graph below) declined for the month by -0.2%, and is 3.6% below its February peak. Meanwhile real personal income (red), which has generally declined since April, rose 0.6%, and remains 1.3% higher than it was in February just before the pandemic hit:

The continued strength in income compared with prior to the pandemic has everything to do with the emergency stimulus Congress put in place early on after the pandemic hit. This has greatly ameliorated the privation which would otherwise have occurred.

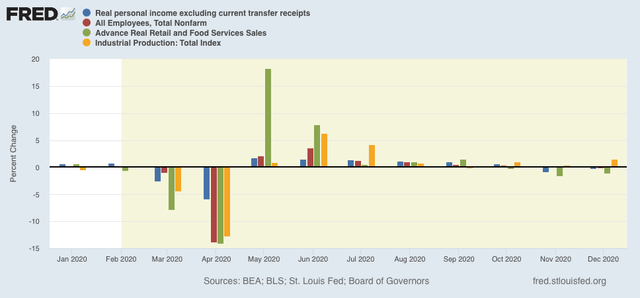

Further, real personal income excluding transfer payments (I.e., payments from the government like food stamps and unemployment insurance) is one of the four coincident indicators which the NBER makes use of in determining if the economy is expanding or not. This also declined -0.2% in December, the second monthly decline in a row after increasing in the 6 prior months. In the below graph I show that (blue) together with jobs (red), real retail sales (green), and industrial production (gold) for the year 2020:

All four of these data points have been deteriorating since strong rebounds in May and June. Two (sales and income) were negative in November, and payrolls also went negative in December. Because industrial production is the King of Coincident Indicators, however, I doubt the NBER will mark a renewed recession beginning in either month. Still, *if* production rolls over, and the other three decline further in January, that might mean the start of a “double-dip.” But because I expect the pandemic to be brought somewhat under control by spring sometime, I further suspect that it won’t be enough to qualify as a renewed recession.