September industrial production turns down, but no major cause for concern Industrial production is the King of Coincident Indicators. This morning’s report for September was negative, and August was revised downward, taking total production back below pre-pandemic levels. Total production decreased -1.3% in September, and the manufacturing component decreased -0.8%. The August reading for each was revised downward by -0.3%. Nothing particularly special about that; in fact, the manufacturing component was a little weak compared with most recent months. Additionally, the July numbers were revised slightly (not significantly) higher and lower for each, respectively. As a result, manufacturing is now only 0.4% above February 2020, and total

Topics:

NewDealdemocrat considers the following as important: industrial production, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

September industrial production turns down, but no major cause for concern

Industrial production is the King of Coincident Indicators. This morning’s report for September was negative, and August was revised downward, taking total production back below pre-pandemic levels.

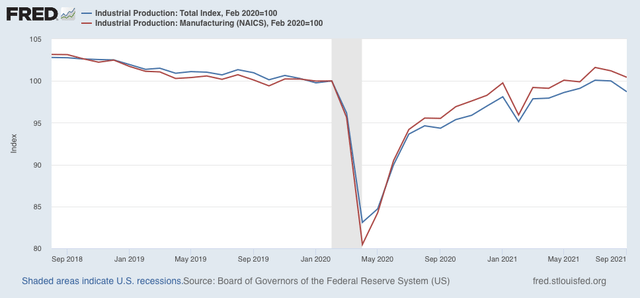

Total production decreased -1.3% in September, and the manufacturing component decreased -0.8%. The August reading for each was revised downward by -0.3%. Nothing particularly special about that; in fact, the manufacturing component was a little weak compared with most recent months. Additionally, the July numbers were revised slightly (not significantly) higher and lower for each, respectively. As a result, manufacturing is now only 0.4% above February 2020, and total production is down -1.3% compared with just before the pandemic:

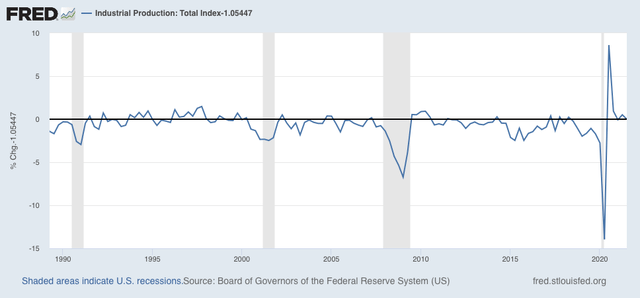

Needless to say, this is very much at odds with the continuing very positive ISM manufacturing index readings which we have gotten every month this year. The Fed regional manufacturing indexes, as well as the Chicago PMI, also remain positive, so I am not terribly concerned about one poor month (which needless to say may also be revised!). This morning’s report is probably going to prompt some scary downward revisions to forecasts of Q3 GDP, which will be released one week from Thursday. But when we look at quarter-over-quarter numbers, industrial production is still up 1.1% from Q2 of this year. In the below graph, I’ve subtracted that number so that it norms to zero, to compare that increase with the past 30+ years:

As you can see, while it isn’t the strongest reading, it is higher than most quarters during the 3 expansions since 1989, and is nowhere near recessionary. So, while we’re almost certainly going to see a sharp *deceleration* from the blockbuster last several quarters in q/q GDP next week, in absolute terms I do not see any particular cause for concern.