Jobless claims: steady as she goes by New Deal democrat [ Special programming note: yesterday’s Fed action, and more important the statements made afterward, merit special attention. I will put up a special post on that later today.] Initial jobless claims remained at their recent low level, down -1,000 from one week ago to 217,000. The 4 week average declined -500 to 218,750. Continuing claims, which lag slightly, rose 47,500 to a 7 month high of 1,485,000: The recent upturn and downturn in jobless claims looks bigger in this graph than it has in the past two years, but it is all because the big numbers of 2020 and earlier n 2021 have disappeared from this 1 year timeframe. At any point in the past half century, jobless claims on the

Topics:

NewDealdemocrat considers the following as important: Hot Topics, NDd, politics, Unemployment, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Jobless claims: steady as she goes

by New Deal democrat

[ Special programming note: yesterday’s Fed action, and more important the statements made afterward, merit special attention. I will put up a special post on that later today.]

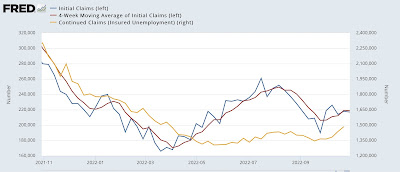

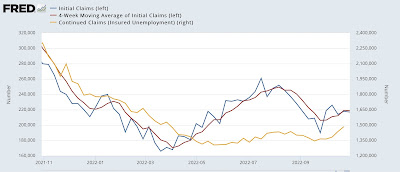

Initial jobless claims remained at their recent low level, down -1,000 from one week ago to 217,000. The 4 week average declined -500 to 218,750. Continuing claims, which lag slightly, rose 47,500 to a 7 month high of 1,485,000:

The recent upturn and downturn in jobless claims looks bigger in this graph than it has in the past two years, but it is all because the big numbers of 2020 and earlier n 2021 have disappeared from this 1 year timeframe. At any point in the past half century, jobless claims on the order of 300,000/week (as they were 1 year ago) would have been considered very good indeed.

So, this remains good news. Very few people are getting laid off.

There are a few implications for tomorrow’s jobs report, so let’s briefly update those.

First, jobless claims lead the unemployment rate by several months. Here are the 4 week average of jobless claims (red) vs the unemployment rate (blue) for the past two years:

I expect that the 3.5% unemployment rate recorded in July and September will likely be the low for this expansion, although so far there is no reason to expect any big increase.

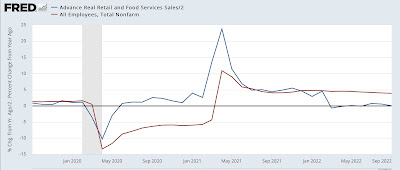

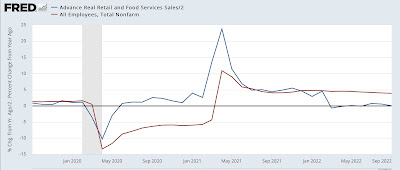

Second, consumption leads employment. Here is a graph updated through last month’s data for real retail sales (blue, /2 for scale) and monthly % of job gains (red):

Average YoY job gains monthly have been slowly decreasing this year. Except for the big positive outlier in July (+537,000 jobs), since March they have trended down from +398,000 jobs to +263,000 in September. While any given month’s number can be volatile, the trend in consumption strongly suggests that this decreasing trend in job gains will continue tomorrow’s report for October.

Jobless claims: steady as she goes

– by New Deal democrat

[ Special programming note: yesterday’s Fed action, and more important the statements made afterward, merit special attention. I will put up a special post on that later today.]

Initial jobless claims remained at their recent low level, down -1,000 from one week ago to 217,000. The 4 week average declined -500 to 218,750. Continuing claims, which lag slightly, rose 47,500 to a 7 month high of 1,485,000:

The recent upturn and downturn in jobless claims looks bigger in this graph than it has in the past two years, but it is all because the big numbers of 2020 and earlier n 2021 have disappeared from this 1 year timeframe. At any point in the past half century, jobless claims on the order of 300,000/week (as they were 1 year ago) would have been considered very good indeed.

So, this remains good news. Very few people are getting laid off.

There are a few implications for tomorrow’s jobs report, so let’s briefly update those.

First, jobless claims lead the unemployment rate by several months. Here are the 4 week average of jobless claims (red) vs the unemployment rate (blue) for the past two years:

I expect that the 3.5% unemployment rate recorded in July and September will likely be the low for this expansion, although so far there is no reason to expect any big increase.

Second, consumption leads employment. Here is a graph updated through last month’s data for real retail sales (blue, /2 for scale) and monthly % of job gains (red):

Average YoY job gains monthly have been slowly decreasing this year. Except for the big positive outlier in July (+537,000 jobs), since March they have trended down from +398,000 jobs to +263,000 in September. While any given month’s number can be volatile, the trend in consumption strongly suggests that this decreasing trend in job gains will continue tomorrow’s report for October.

“Jobless claims flat for the moment,” Angry Bear, New Deal democrat.