Manufacturing, construction, and job openings all show an economy under stress – by New Deal democrat As usual, we begin another month with important manufacturing and construction data. Additionally, the JOLTS report for September was also released. The ISM manufacturing index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession, and in three cases did not actually cross the line until the first month of the recession itself – although the recession did not begin until after the total index fell below 50, and in fact usually below 48. In September the overall index declined once again to 50.2 – the lowest reading since May 2020), while the more

Topics:

NewDealdemocrat considers the following as important: Mfg Cons Jobs, NDd, politics, US EConomics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Manufacturing, construction, and job openings all show an economy under stress

– by New Deal democrat

As usual, we begin another month with important manufacturing and construction data. Additionally, the JOLTS report for September was also released.

The ISM manufacturing index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession, and in three cases did not actually cross the line until the first month of the recession itself – although the recession did not begin until after the total index fell below 50, and in fact usually below 48.

In September the overall index declined once again to 50.2 – the lowest reading since May 2020), while the more leading new orders index, which has been in slight contraction beginning in June, rose from its September low of 47.1 to 49.2:

This remains consistent with readings right before the onset of the Great Recession, but also with several slowdowns that did not quite turn into recessions.

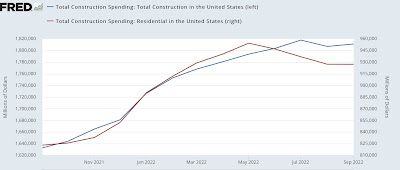

Meanwhile construction spending, both in total and residential, rose slightly nominally, although both are below their July and May peaks, respectively:

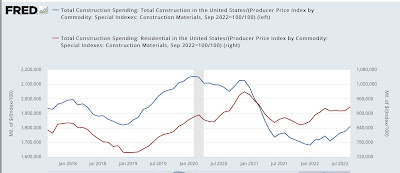

Interestingly, adjusting for the cost of construction materials, both have risen significantly since the beginning of this year:

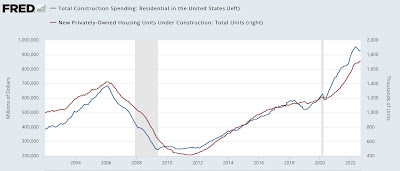

Here is a comparison of residential construction spending (blue) with houses under construction from the permits and starts report (red):

The two have tended to move in tandem for the past 20 years. The former has peaked, while the latter appears to be in the process of peaking now. Since construction and its attendant spending is the “real” economic activity of new housing, a decline in the two is a negative sign for the economy going forward.

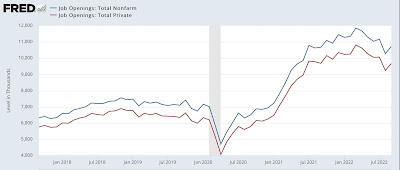

Finally, I’ll write a more comprehensive update on the JOLTS report tomorrow. The most important news is in job openings, which improved this month, but only because last month’s were revised even lower. The sharp downward trend remains clear:

All three of these reports show an economy under stress, although not yet in recession.

“September manufacturing new orders and August construction spending both turn down,” Angry Bear