Manufacturing and construction start out the month with positive prints As per usual, the new month starts with updates on manufacturing and construction. The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. This remained positive, but there has been a definite slowing in the past two months. In April the index declined from 57.1 to 55.4, and the new orders subindex also declined from 53.8 to 53.5, the lowest reading since 2020. As noted above, these remain positive, since the breakeven point between expansion and contraction is 50: This forecasts a continued expansion on the production side of the economy through summer – but nowhere near the red-hot and

Topics:

NewDealdemocrat considers the following as important: manufacturing and construction, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Manufacturing and construction start out the month with positive prints

As per usual, the new month starts with updates on manufacturing and construction.

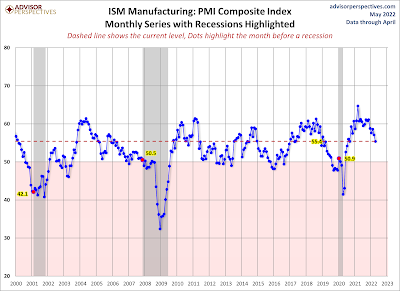

The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. This remained positive, but there has been a definite slowing in the past two months.

In April the index declined from 57.1 to 55.4, and the new orders subindex also declined from 53.8 to 53.5, the lowest reading since 2020. As noted above, these remain positive, since the breakeven point between expansion and contraction is 50:

This forecasts a continued expansion on the production side of the economy through summer – but nowhere near the red-hot and even white-hot pace of last year.

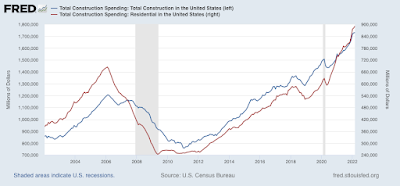

Meanwhile, construction spending for March rose 0.1% in nominal terms for overall spending including all types of construction, while the leading residential sector also rose 1.0%, both thus making new highs:

On a YoY basis, nominal residential construction spending is up 18.2%!

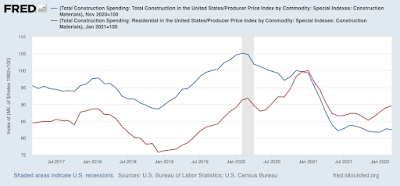

Adjusting for price changes in construction materials, which rose 0.4% for the month, and have *declined* ever so slightly in the last two months combined, “real” construction spending declined -0.3% m/m, and residential spending rose 0.6% m/m. In absolute terms, “real” construction spending has declined sharply – by -17.4% – since its peak in November 2020, while “real” residential construction spending has declined -10.4% since its post-recession peak in January of last year, and risen by about 5% in the past several months:

While total construction spending has declined by more than the -10.4% it did before the Great Recession, the decline in residential construction spending, while increasingly substantial, remains nowhere near the -40.1% decline it suffered before the end of 2007. In general, this series has been helped considerably by the fact that the cost of construction materials has stopped rising, at least for now.

Together, these two reports point to continued growth, albeit at a slower pace, in manufacturing and construction* in the next few months.

*recalling that it takes a while for the downturn in mortgage applications and sales to filter through into actual construction.