March consumer inflation part 2: I told you so; the Fed *must* start paying attention to house price indexes This is the second part of my take on the March consumer inflation report. As you may have already read, total inflation clocked in at +1.2% for March alone! YoY consumer prices are up 8.6%, the highest 12-month rate since 1981. As anticipated, gas prices were a huge contributor; less energy, prices were up 0.4%; less both food and energy they were only up 0.3%: The spike in gas prices may be – to use a recently dreaded word – transitory. In the past 4 weeks, gas prices are down 5%; as of this morning oil prices, which had been as high as 3/barrel on March 8, are back under 0. There was some small good news in one

Topics:

NewDealdemocrat considers the following as important: consumer inflation, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

March consumer inflation part 2: I told you so; the Fed *must* start paying attention to house price indexes

This is the second part of my take on the March consumer inflation report.

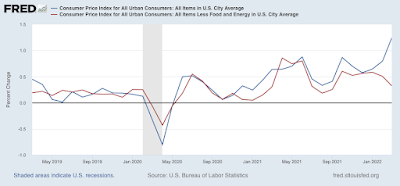

As you may have already read, total inflation clocked in at +1.2% for March alone! YoY consumer prices are up 8.6%, the highest 12-month rate since 1981. As anticipated, gas prices were a huge contributor; less energy, prices were up 0.4%; less both food and energy they were only up 0.3%:

The spike in gas prices may be – to use a recently dreaded word – transitory. In the past 4 weeks, gas prices are down 5%; as of this morning oil prices, which had been as high as $123/barrel on March 8, are back under $100.

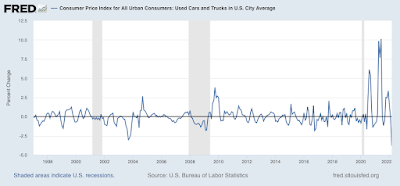

There was some small good news in one sector: the price of used cars and trucks fell -3.8% in March:

but prices are still up 35% YoY:

And of course, used vehicle prices are down because they have become unaffordable for enough people that sales of such vehicles have also turned down.

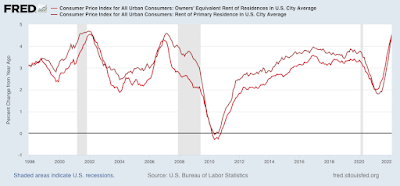

But I want to focus on the housing component of CPI, which constitutes over 33% of the total input. There, both rent, and the much larger CPI component of owner’s equivalent rent, which is how house prices are figured into inflation, rose 0.4% for the month, and are up 4.4% and 4.5% YoY, respectively. This is the highest YoY rate of housing inflation for either measure since 2002.

Further, I fully expect the housing component of inflation to continue to worsen considerably. That’s because, as I first pointed out half a year ago, the major house price indexes – the FHFA index and the Case Shiller index – lead owners equivalent rent by roughly 12 to 24 months, particularly in major moves.

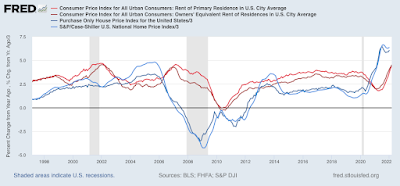

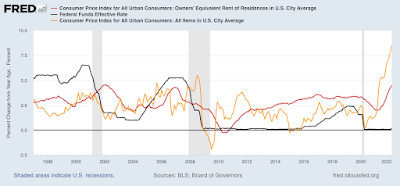

The below graph shows the YoY% change in both house price indexes in shades of blue, compared with the YoY% changes in the CPI measures of rent of primary residence, and owners’ equivalent rent in shades of red:

There have been 3 major pulses of house price increases in the last 25 years: in 1997-98, 2004-06, and 2020-present. In each case, after roughly a 12-24 month lag, both CPI rent measures surged as well. That’s because big surges in house prices make renting more attractive (or necessary for those on more limited budgets); this drives more demand for apartments, which drives rent increases. And the current rise in house prices of nearly 20% YoY, is significantly worse than either of the previous two. With CPI housing inflation already at a 20-year high, we can further record CPI housing increases as this year progresses.

As I have also pointed out before owners’ equivalent rent is fully passed through into CPI, total inflation has normally cooled, as shown in the graph below:

But that is because, faced with surging inflation, the Fed has embarked on a series of rate hikes (shown in black above) that culminated before owners’ equivalent rent peaked. The economy buckled, recessions started, and total inflation subsided as a result before owners’ equivalent rent had fully peaked.

Unfortunately, even after the record surge in house prices was in full swing over a year ago, the Fed stayed on the sidelines. Now rents, and owners’ equivalent rents, are surging as well, and the Fed has only made one 1/4 point rate hike. Now the Fed is almost certainly going to stomp on the brakes, with a hard landing to follow.

It’s too late for this cycle. But with three examples of surging house prices feeding through with a delay into the CPI in the past 25 years, in the future, the Fed simply *must* pay attention to house prices as reflected in those indexes. Better a small tamping down of the economy early than a major sudden stop later.