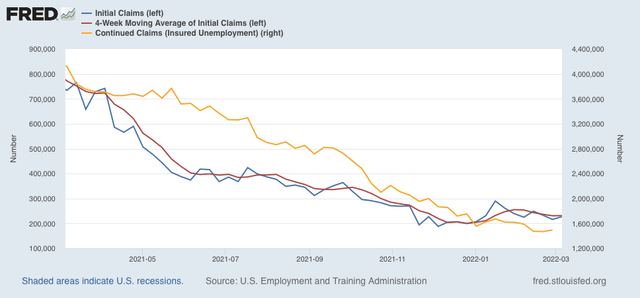

Yet another new 50+ year low in continuing jobless claims After 3 days of a data desert, today there is a cornucopia of data: not just initial claims, but housing starts and permits, and industrial production as well. On top of that, a large stretch of the yield curve in the bond market is close to inverting after yesterday’s Fed rate hike. I’ll report on housing and production later; below is the read on new and continuing jobless claims. Initial claims (blue) declined 15,000 to 214,000 (vs. the pandemic low of 188,000 on December 4). The 4 week average (red) declined 8750 to 223,000 (vs. the pandemic low of 199,750 on December 25). Continuing claims (gold, right scale) declined 71,000 to 1,419,000, which is not only a new pandemic low, but

Topics:

NewDealdemocrat considers the following as important: continuing jobless claims, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Yet another new 50+ year low in continuing jobless claims

After 3 days of a data desert, today there is a cornucopia of data: not just initial claims, but housing starts and permits, and industrial production as well. On top of that, a large stretch of the yield curve in the bond market is close to inverting after yesterday’s Fed rate hike. I’ll report on housing and production later; below is the read on new and continuing jobless claims.

Initial claims (blue) declined 15,000 to 214,000 (vs. the pandemic low of 188,000 on December 4). The 4 week average (red) declined 8750 to 223,000 (vs. the pandemic low of 199,750 on December 25). Continuing claims (gold, right scale) declined 71,000 to 1,419,000, which is not only a new pandemic low, but also the lowest number in over 50 years:

The temporary increase in claims due to Omicron has ended, but I still think we have probably seen the lows in initial claims for this expansion. But with continuing claims continuing at 50 year+ lows, the record tightness in the jobs market isn’t going away. The number of jobs available relative to the number of applicants will remain tight, meaning there will be continuing upward pressure on wages.