November housing permits and starts: the biggest news is not in the headlines – by New Deal democrat The report on housing construction for November was very much a tale of two very different trends – and the most important one will almost certainly be under-reported. Housing permits issued declined to 1.342 million annualized, the lowest number since June 2020, and before the pandemic the lowest since July 2019. The even more reliable single family permits declined to 781,000 annualized, the lowest since May 2020, and before that November 2016! Finally, the more volatile housing starts declined to 1.427 million annualized, the lowest since August 2020. Here’s the graph showing all three: Those are all big declines, and definitely

Topics:

NewDealdemocrat considers the following as important: Hot Topics, housing permits and starts, New Deal Democrat, Taxes/regulation, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

November housing permits and starts: the biggest news is not in the headlines

– by New Deal democrat

The report on housing construction for November was very much a tale of two very different trends – and the most important one will almost certainly be under-reported.

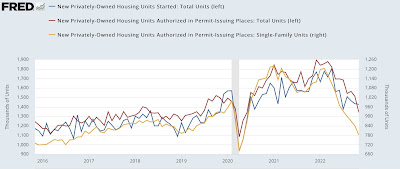

Housing permits issued declined to 1.342 million annualized, the lowest number since June 2020, and before the pandemic the lowest since July 2019. The even more reliable single family permits declined to 781,000 annualized, the lowest since May 2020, and before that November 2016! Finally, the more volatile housing starts declined to 1.427 million annualized, the lowest since August 2020. Here’s the graph showing all three:

Those are all big declines, and definitely recessionary. But they’re not the biggest story.

For one thing, the backlog of housing units authorized but not yet started declined only slightly to 293,000, only slightly below its March peak:

This most likely is much affected by cancellations, which have soared in recent months.

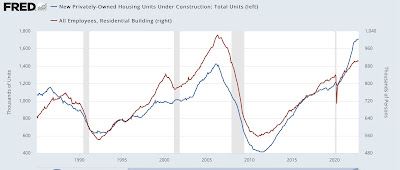

But the big story, in my opinion, has to do with the metric that measures the actual economic activity in the housing sector; namely, housing units under construction. This remained at 1.709 million, tied with last month and at its peak. In the below graph, I also show the number of residential construction workers from the recent jobs report:

In other words, in terms of actual economic activity, housing isn’t yet contributing to a decline. Since units under construction and the number of construction workers typically move in tandem, note that employment has not declined yet either.

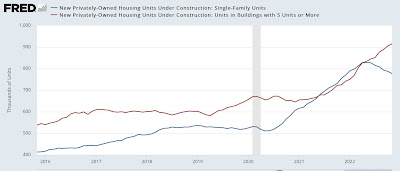

There was some slight movement, in that single family units under construction declined to 777,000, an 11 month low, while multi-unit construction increased to a new high:

This reflects buyers being priced out of the single family market.

Finally, note that mortgage rates have come down significantly in the past eight weeks:

If this persists, we may put in a bottom in housing permits in the next few months, which of course would be good news for 2024.

But, to emphasize again, despite the big declines in the headline numbers, actual economic activity in housing construction remains at its peak.

Housing; permits and starts falling, under construction continues slow rise, Angry Bear, angry bear blog