November real retail sales turn down, return to negative YoY – by New Deal democrat Real retail sales is one of my favorite indicators for both the current economy and the jobs situation 3 to 6 months ahead. This morning nominal retail sales for November were reported down -0.6%, which only takes back about 1/2 of October’s strong +1.3% increase. Since consumer inflation rose +0.1% for the month, real retail sales decreased by -0.5%. Here are the absolute values for real retail sales since the beginning of 2021: Note sales remain -1.1% below their recent peak in April. As I’ve noted many times, YoY real retail sales turning negative YoY for 75 years has been an excellent harbinger of a recession. With this morning’s data, they one

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal, politics, Retail sales, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

November real retail sales turn down, return to negative YoY

– by New Deal democrat

Real retail sales is one of my favorite indicators for both the current economy and the jobs situation 3 to 6 months ahead.

This morning nominal retail sales for November were reported down -0.6%, which only takes back about 1/2 of October’s strong +1.3% increase. Since consumer inflation rose +0.1% for the month, real retail sales decreased by -0.5%. Here are the absolute values for real retail sales since the beginning of 2021:

Note sales remain -1.1% below their recent peak in April.

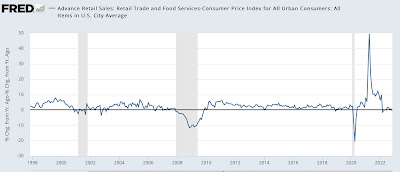

As I’ve noted many times, YoY real retail sales turning negative YoY for 75 years has been an excellent harbinger of a recession. With this morning’s data, they one again have turned negative. Below is the last 25 years of data:

I am willing to discount the negative numbers in the first half of 2022 because they are compared with the strong stimulus-induced spending spree of 2021. But the numbers since June are much more cautionary. In particular, it has been noted that consumer spending has shifted from goods to services this year. While that point has lots of merit, as pandemic related spending fades further into the background, I think the historical relationship will assert itself more and more.

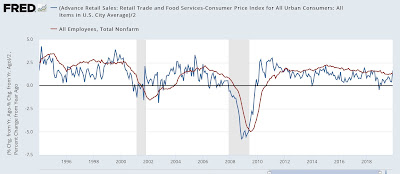

As I’ve also noted many times, real retail sales /2 are a good albeit noisy leading indicator for jobs reports 3-6 months in the future. Here is the historical record since the beginning of the modern retail sales series until just before the pandemic:

And here’s what they look like since June 2021:

That they have continued to be near zero or even negative YoY for many months strongly implies continued deceleration in the monthly jobs numbers over the next few months.