October JOLTS report shows continued deceleration in jobs market, with continuing gap in job openings filled – by New Deal democrat For the past year, I have likened the jobs market to a game of reverse musical chairs, where there are more chairs than players. Some chairs are always left empty. The chairs are jobs, and the players are job seekers. Since the lowest paying jobs have always been left empty, there is tremendous pressure to raise wages. And as job-jumping is rewarded with greater pay increases, there is *continued* inflationary pressure. The October JOLTS report showed both deceleration, but also that the game remains intact. Let’s begin with the long term graph of openings, hires, quits, and total separations since the

Topics:

NewDealdemocrat considers the following as important: New Deal Democrat, October Jolts, US/Global Economics

This could be interesting, too:

Joel Eissenberg writes How Tesla makes money

Angry Bear writes True pricing: effects on competition

Angry Bear writes The paradox of economic competition

Angry Bear writes USMAC Exempts Certain Items Coming out of Mexico and Canada

October JOLTS report shows continued deceleration in jobs market, with continuing gap in job openings filled

– by New Deal democrat

For the past year, I have likened the jobs market to a game of reverse musical chairs, where there are more chairs than players. Some chairs are always left empty. The chairs are jobs, and the players are job seekers. Since the lowest paying jobs have always been left empty, there is tremendous pressure to raise wages. And as job-jumping is rewarded with greater pay increases, there is *continued* inflationary pressure.

The October JOLTS report showed both deceleration, but also that the game remains intact.

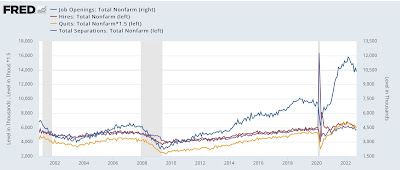

Let’s begin with the long term graph of openings, hires, quits, and total separations since the beginning of the series:

A year ago hires, quits, and separations were all at their highest levels since the series began, equivalent to 2006 and 2019. Openings were sky high, 50% higher than even their best levels before the pandemic. This was simply tremendous pressure on employers to raise wages and increase benefits in order to attract job seekers – and many slots went unfilled.

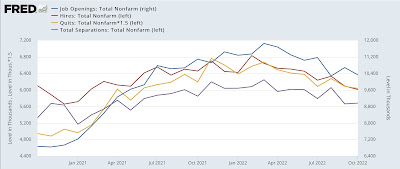

Now here is a close-up of the last 2 years in the above data:

All 4 series hit their best levels in the first few months of this year, and all have deteriorated since. Hires declined 84,000 in October to their lowest level since January 2021. Quits declined 34,000 to their lowest level since May 2021. Total separations did rise 18,000 for the month, but otherwise also were at the lowest level since May 2021.

Finally, openings declined 353,000 for the month, but remained 64,000 above August’s level. Whether the last several months indicate a pause in the downward trajectory of that metric remains to be seen, but aside from August, October was the lowest level since June 2021.

Layoffs and discharges make bottoms during expansions and increase leading into recessions. They did increase by 58,000 in October, but remained generally in line with their level for the past 18 months:

By way of contrast, during the previous two expansions, quits averaged between 1.6M-2.0M per month. During the Great Recession, they rose as high as 2.650M.

In summary, the October JOLTS report shows that while the game of musical chairs remains intact, the overall theme of deceleration has continued. Some employers may be keeping job openings up formally, but choosing not to fill them due to wage pressures or a decline in overall demand.

“August JOLTS report: the game of reverse musical chairs in the jobs market is ending,” Angry Bear, angry bear blog