Real income continued to fall in June, while consumers dug deeper to spend – by New Deal democrat In June personal income rose 0.6% nominally, and nominal spending rose 1.1%. The personal consumption deflator, i.e., the relevant measure of inflation, clocked in at 1.0%, meaning real income fell -0.4%, while real personal spending rose 0.1%. I have been comparing both real personal income and spending with that with their level after early 2021’s round of stimulus. Accordingly, the below graph is normed to 100 as of May 2021: Since then, real spending is up 2.2%, while real income has actually declined by -1.3%. Comparing real personal consumption expenditures with real retail sales for May (essentially, both sides of the consumption

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, real income, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Real income continued to fall in June, while consumers dug deeper to spend

– by New Deal democrat

In June personal income rose 0.6% nominally, and nominal spending rose 1.1%. The personal consumption deflator, i.e., the relevant measure of inflation, clocked in at 1.0%, meaning real income fell -0.4%, while real personal spending rose 0.1%.

I have been comparing both real personal income and spending with that with their level after early 2021’s round of stimulus. Accordingly, the below graph is normed to 100 as of May 2021:

Since then, real spending is up 2.2%, while real income has actually declined by -1.3%.

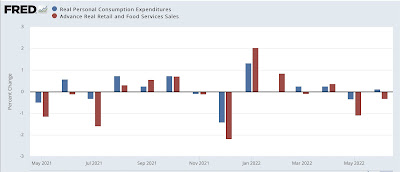

Comparing real personal consumption expenditures with real retail sales for May (essentially, both sides of the consumption coin) shows that both were close to flat:

Finally, the personal saving rate declined -0.4% to 5.1%, the lowest since right after the Great Recession in 2009 (note: below graph subtracts -5.1% to norm the current reading at zero):

Usually the savings rate tends to decrease as expansions grow longer, leaving consumers more vulnerable to shocks (e.g., gas prices); and June’s suggests that consumers are digging deeper into savings in order to make purchases. Which isn’t entirely bad news, since recessions typically start when consumers get spooked enough to increase their savings rate.

The bad news is that the last two months have been below the April peak in real personal spending; the good news is that this report confirms the very modest increase in Quarterly real spending that we saw in yesterday’s GDP report.

In short, a very mixed report, as real incomes continue to fall, while consumers are sanguine enough to dig a little deeper and keep spending rather than pull back.