Producer prices continue sharp deceleration; real average and aggregate nonsupervisory pay continues to increase – by New Deal democrat Historically producer prices were more upstream of consumer prices, but since the 1990s and the employment of “just-in-time” inventories, that has been less the case. So I normally don’t pay too much attention to the monthly PPI. But for the record, PPI continues to confirm, and amplify, what we’ve seen in CPI. That is, a steep decline in monthly readings compared with a year ago, causing the YoY comparisons to decline sharply as well. Headline PPI is now only up 1.2% YoY, while commodity prices are down -7.1%: Here’s how headline PPI compares with headline CPI YoY: And here’s how core PPI (up 5.0%

Topics:

NewDealdemocrat considers the following as important: average and aggregate nonsupervisory pay, Hot Topics, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Producer prices continue sharp deceleration; real average and aggregate nonsupervisory pay continues to increase

– by New Deal democrat

Historically producer prices were more upstream of consumer prices, but since the 1990s and the employment of “just-in-time” inventories, that has been less the case. So I normally don’t pay too much attention to the monthly PPI.

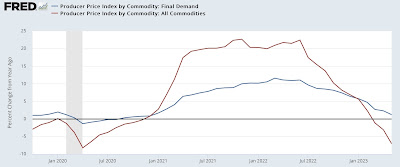

But for the record, PPI continues to confirm, and amplify, what we’ve seen in CPI. That is, a steep decline in monthly readings compared with a year ago, causing the YoY comparisons to decline sharply as well.

Headline PPI is now only up 1.2% YoY, while commodity prices are down -7.1%:

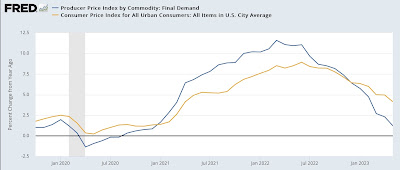

Here’s how headline PPI compares with headline CPI YoY:

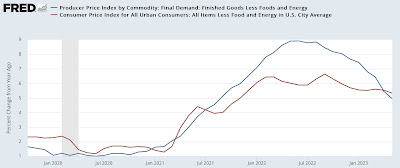

And here’s how core PPI (up 5.0% YoY) compares with core CPI (up 5.3%YoY):

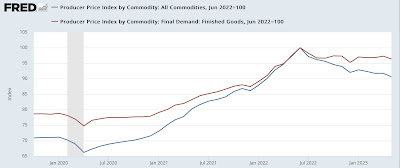

Since last June’s inflection point, final demand PPI is down -3.6% and commodities are down -9.4%:

In short, deceleration and even outright decline all around. Keep in mind that one big difference is that unlike CPI, PPI does not have a significant “shelter” component.

Meanwhile, yesterday’s CPI report also allows us to update several important income metrics for the American working and middle class.

Real average hourly earnings in May increased 0.3%, continuing their rise since last June’s inflection point at peak gas prices:

And aggregate payrolls for nonsupervisory workers also increased YoY:

This latter metric is an excellent “fundamentals-based” marker for recessions, which almost always occur when it goes negative. This improvement is the best argument against there being any imminent recession – in the aggregate, in real terms, average American households are bringing home more income.

Real wages unchanged, real aggregate payrolls rose slightly in April, Angry Bear, New Deal democrat