April report for real personal income and spending adds to the evidence that a cyclical peak might ultimately be dated to January – by New Deal democrat As I’ve repeated for the past several months, at present the report on personal income and spending is co-equal to the employment report as the most important monthly data. And for the second month in a row, the results were very mixed. And also, like yesterday, revisions played a big role, this time to the downside. Nominally, personal income rose 0.4%, and personal spending rose 0.8%. Because the applicable deflator rose 0.4%, real personal income was unchanged, and real personal spending rounded to up 0.5%. And real disposable personal income rose less than 0.1% rounding to unchanged.

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, personal income and spending, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

April report for real personal income and spending adds to the evidence that a cyclical peak might ultimately be dated to January

– by New Deal democrat

As I’ve repeated for the past several months, at present the report on personal income and spending is co-equal to the employment report as the most important monthly data. And for the second month in a row, the results were very mixed. And also, like yesterday, revisions played a big role, this time to the downside.

Nominally, personal income rose 0.4%, and personal spending rose 0.8%. Because the applicable deflator rose 0.4%, real personal income was unchanged, and real personal spending rounded to up 0.5%. And real disposable personal income rose less than 0.1% rounding to unchanged.

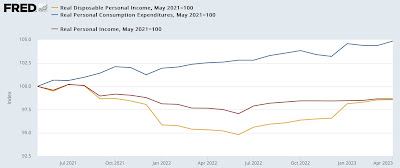

Since the pandemic began, real income is up 3.3% (vs. a reported 4.0% in March), and real spending is up 8.2% (vs. 7.6% in March). Because much of this was distorted by several rounds of stimulus, here’s the view normed to 100 as of July 2021, also including real disposable personal income (gold), which is much more affected by gas prices:

Note that net revisions added 0.1% to the increase in spending, but revisions subtracted a large -0.7% from income.

Revisions also affected the pesonal savings rate, which was also revised down -0.6% for March from 5.1% to 4.5%, and then declined another -0.4% in April to 4.1%. Due to the “paradox of saving,” while this decline in a negative for individual households, it is good for the economy as a whole, since consumption makes up 70% of economic activity, and consumption leads employment.

In the long term, though, this rate of saving is very low, only exceeded to the downside in the 50 years prior to the pandemic by the period from November 2004 through September 2008:

Finally, let’s turn to the indicators that the NBER uses to determine the onset of and end of recessions, two of which were updated this morning.

The good news is that real personal income less government transfers (blue in the graph below) rose 0.2% in April to a new high. The bad news is that this is against some very big downward revisions for the past 6 months, meaning that April’s “record” is actually -0.6% below where we thought we were in March, and less than 0.1% above its now-previous record of last September:

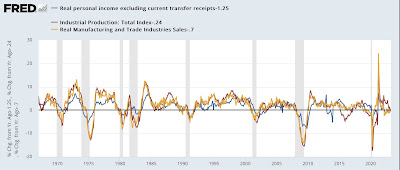

The other big coincident indicator used by the NBER updated today, real manufacturing and trade sales for March, declined another -0.6% from their recent high in January:

Here is what all of the “big 4” coincident indicators, including industrial production and nonfarm payrolls, look like each normed to 100 as of their respective peaks:

Two of the four – industrial production and real manufacturing and trade sales – are down from their peaks. A third, real personal income less transfer receipts, has essentially been flat since last September. Only jobs have continued to increase significantly.

Further, on a YoY basis, real personal income less government transfers is up 1.2%, industrial production is up 0.2%, and real manufacturing and trade sales are up 0.7%. The historical record going back over half a century shows that when all three of these coincident indicators have been at their current YoY levels they are now, with *no* exceptions a recession was already underway:

In summary, while there was good news on real personal spending and on real personal income less government transfers; there were very negative revisions to income. While it remains unlikely, together with yesterday’s report of negative Gross Domestic Income for Q1, including the average of GDP and GDI; this report increases the chances that ultimately the NBER will discount the continuing growth in nonfarm payrolls and declare that there was a cyclical peak in January.