What to look for in tomorrow’s CPI and Friday’s PPI – by New Deal democrat We’re still in the post-jobs report lull in economic news today. That will end tomorrow with initial jobless claims, and also CPI and PPI tomorrow and Friday respectively. I always watch CPI, but I believe the PPI is uniquely important at present as well. To show you why, let me show you the YoY relationship between PPI and CPI for the past 75 years in two graphs below: I’d like to focus your attention on those times when (1) both PPI and CPI were decelerating or declining YoY, and (2) PPI was decelerating or declining at a faster pace than CPI. Until recently, this relationship typically has occurred either in the latter part of recessions, or else early

Topics:

NewDealdemocrat considers the following as important: CPI, Hot Topics, New Deal Democrat, PPI, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

What to look for in tomorrow’s CPI and Friday’s PPI

– by New Deal democrat

We’re still in the post-jobs report lull in economic news today. That will end tomorrow with initial jobless claims, and also CPI and PPI tomorrow and Friday respectively.

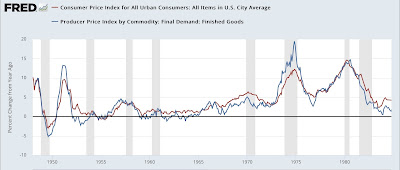

I always watch CPI, but I believe the PPI is uniquely important at present as well. To show you why, let me show you the YoY relationship between PPI and CPI for the past 75 years in two graphs below:

I’d like to focus your attention on those times when (1) both PPI and CPI were decelerating or declining YoY, and (2) PPI was decelerating or declining at a faster pace than CPI.

Until recently, this relationship typically has occurred either in the latter part of recessions, or else early in recoveries just after the end of recessions. That’s because recessions kill demand, and since producer prices are more volatile than consumer prices, producer prices go down faster. Which lays the groundwork for the next expansion, as producers can produce goods more cheaply, enabling consumers to get a good deal – thus stimulating demand again.

But the relationship also has happened repeatedly in the middle of expansions in the past 40 years. Not always, but some of the time that has been not because of a decrease in demand, but rather an increase in the supply of commodities, chiefly but not necessarily limited to gas and oil. In those cases, consumers have just motored right through what otherwise would have looked like recessions.

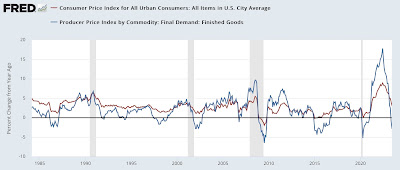

Now cast your eyes to the far right. In the past year, commodity prices have declined almost 10% – one of the steepest declines ever. And that has *not* been because of a massive killing of demand, but rather because supply chain bottlenecks created by the pandemic have unspooled dramatically.

At present the YoY% change in PPI prices are running -12.6% below that for the CPI, the highest in the entire 75 year period except for the very bottom of the Great Recession:

I am increasingly of the opinion that this amounts to a hurricane force tailwind behind the economy.

So tomorrow and Friday I will be looking to see if this trend continues, or if there are signs of a reversal. Tomorrow that may be evident in CPI ex-fictitious shelter, and on Friday we may see the first increase in PPI for raw commodities since January and only the second in the past year. If the downward trend continues, the tailwind is continuing. If the downward spiral breaks, then as the tailwind abates the lagged effects of Fed rate hikes will likely come to the fore.

Real hourly and aggregate wages update; plus further comments on consumer and producer inflation, Angry Bear, New Deal democrat