A Fed nightmare? Housing permits and starts confirm improvement from bottom, multi-unit construction sets new record high – by New Deal democrat Housing construction is perhaps the single most important method by which the Fed seeks to translate its interest rate policy into effects on the economy. To be blunt, the Fed’s sledgehammer attempt via one of the most aggressive rate hike campaigns in its history appears to be on the verge of failure. That’s because housing construction, more than a year after the Fed started its campaign, is not meaningfully cooperating. Let’s go to the numbers . . . In April housing starts increased by 30,000 at an annualized rate to 1.401 million. Permits declined -21,000 to 1.416 million, and single

Topics:

NewDealdemocrat considers the following as important: housing permits, Multi Unit Construction, New Deal Democrat, Uncategorized

This could be interesting, too:

tom writes The Ukraine war and Europe’s deepening march of folly

Stavros Mavroudeas writes CfP of Marxist Macroeconomic Modelling workgroup – 18th WAPE Forum, Istanbul August 6-8, 2025

Lars Pålsson Syll writes The pretence-of-knowledge syndrome

Dean Baker writes Crypto and Donald Trump’s strategic baseball card reserve

A Fed nightmare? Housing permits and starts confirm improvement from bottom, multi-unit construction sets new record high

– by New Deal democrat

Housing construction is perhaps the single most important method by which the Fed seeks to translate its interest rate policy into effects on the economy.

To be blunt, the Fed’s sledgehammer attempt via one of the most aggressive rate hike campaigns in its history appears to be on the verge of failure. That’s because housing construction, more than a year after the Fed started its campaign, is not meaningfully cooperating.

Let’s go to the numbers . . .

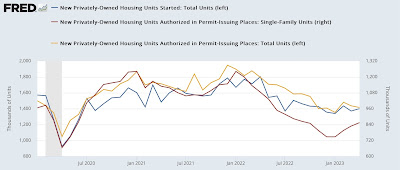

In April housing starts increased by 30,000 at an annualized rate to 1.401 million. Permits declined -21,000 to 1.416 million, and single family permits, which are the least volatile among the leading metrics, increased 26,000 to 855,000. These are 87,000, 76,000, and 107,000 units, respectively, higher than their January lows:

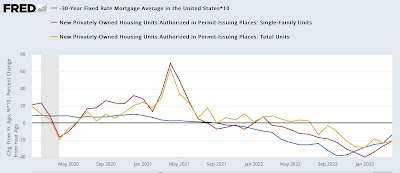

This is unsurprising, since mortgage rates made their highs of just over 7% at the end of November. Below is the update of the graph I have run for over a decade showing the YoY% changes in mortgage rates (inverted, *10 for scale), total and single family permits:

I wrote last month that it appeared the bottom was in, and today’s report gives us more confirmation of the same.

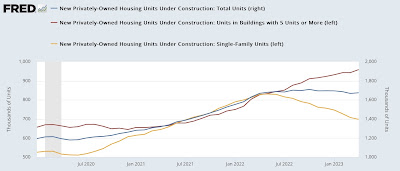

But perhaps the biggest news is what happened with total units under construction. They *increased* by 7,000, and are only -2% lower than their peak half a year ago. While single family units under construction did decline by -10,000, that was more than offset by the continued rise, by 16,000, in multi-family units under construction:

The 959,000 multi-family units under construction is a new all-time high.

The Fed has been raising rates in order to get its preferred metric of inflation down to 2% YoY. I have been pointing out for months that the only important sector that has not decelerated sharply towards that figure is shelter. Total housing under construction only -2% below its all-time peak is not creating meaningful slack in construction prices, and so far housing prices as measured by both Case-Shiller and the FHFA (not shown) are only -5% and less than -1% from their all-time highs as well.

So the good news is, housing is not killing the economy. Not by a long shot. The bad news is, this is going to give continued ammunition to Fed hawks either not to pause, or worse to continue the interest rate hikes, until the economy begs for mercy.

Existing home sales and prices decline; plus, a closer look at multi-unit housing construction, Angry Bear, New Deal democrat