Financial markets in past fiscal crises; the “gold standard” of employment reports shows big deceleration in Q4 of last year – by New Deal democrat I have a post up at Seeking Alpha on how stocks, bonds, and consumers behaved during the 3 fiscal crises of the last decade. Hint: recessions are always disinflationary. Also of interest: the “gold standard” of employment data is the Quarterly County Employment and Wages report, which is not a sample, but the full census of 95% of all establishments. Unfortunately, it has two drawbacks: (1) it does not get reported until almost 6 months later, and (2) it can be revised for a full year or more afterward. With those caveats, YoY employment through December of last year decelerated from 4.3% at

Topics:

NewDealdemocrat considers the following as important: County Employment and Wages, Hot Topics, New Deal Democrat, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Financial markets in past fiscal crises; the “gold standard” of employment reports shows big deceleration in Q4 of last year

– by New Deal democrat

I have a post up at Seeking Alpha on how stocks, bonds, and consumers behaved during the 3 fiscal crises of the last decade. Hint: recessions are always disinflationary.

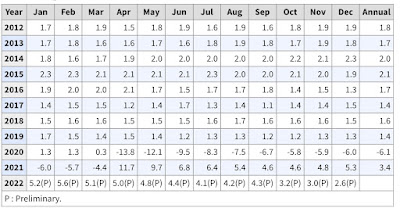

Also of interest: the “gold standard” of employment data is the Quarterly County Employment and Wages report, which is not a sample, but the full census of 95% of all establishments. Unfortunately, it has two drawbacks: (1) it does not get reported until almost 6 months later, and (2) it can be revised for a full year or more afterward.

With those caveats, YoY employment through December of last year decelerated from 4.3% at the end of Q3 to +2.6%, and a total of 152,318,000 jobs:

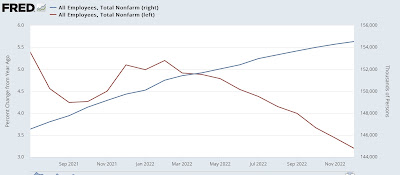

This compares with the monthly jobs report which was up +3.2% YoY (red, left scale) at 154,535,000 jobs (blue, right scale):

We had a similar disconnect for Q2 data, which subsequently got revised away.

Jobless claims hoist yellow flag again; employment and unemployment likely to show further deceleration tomorrow, Angry Bear, New Deal democrat