Higher new home sales, with lower prices in May: good! – by New Deal democrat Let me start with my usual caveat about new home sales: while they are the most leading of all housing metrics, they are very noisy and heavily revised. With that out of the way, the bottom line is that they offered pretty definitive evidence that sales have bottomed, while prices are still declining, at least on a YoY basis. Which makes sense, because as I always sale, prices follow sales. First, here are seasonally adjusted new home sales (blue, left scale) compared with the less leading, but much less noisy single family permits (red, right scale): Both now show a significant and apparently sustained rebound from their respective lows last summer and

Topics:

NewDealdemocrat considers the following as important: 2023, Hot Topics, House Sales, lower prices, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Higher new home sales, with lower prices in May: good!

– by New Deal democrat

Let me start with my usual caveat about new home sales: while they are the most leading of all housing metrics, they are very noisy and heavily revised.

With that out of the way, the bottom line is that they offered pretty definitive evidence that sales have bottomed, while prices are still declining, at least on a YoY basis. Which makes sense, because as I always sale, prices follow sales.

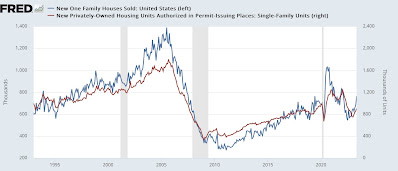

First, here are seasonally adjusted new home sales (blue, left scale) compared with the less leading, but much less noisy single family permits (red, right scale):

Both now show a significant and apparently sustained rebound from their respective lows last summer and winter. Unless the Fed jacks up rates further enough to drive mortgage rates well over 7%, the bottom certainly appears to be in.

Nevertheless, a longer term view shows that even with this rebound, new single family houses are being built and are for sale at no more than a moderate pace compared with the last 30 years:

Note that neither of these metrics include multi-family units, which as I discussed last week, are being built at an all-time record.

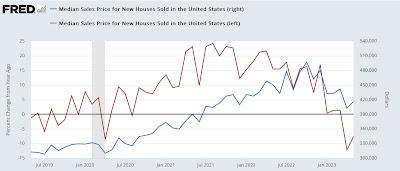

Turning to prices, which follow sales with a lag, there was a non-seasonally adjusted increase of 3.5% for the month (blue, right scale below), while on a YoY basis, prices declined -7.6% (red, left scale):

This was simply a very good report for the economy: lower prices and higher sales. Good!

New home sales and prices: yet another confirmation of a bottom in sales, while prices continue to decline YoY, Angry Bear, New Deal democrat