House price indexes for November: up like a rocket, down like a feather – by New Deal democrat As I’ve repeated many times in the past 10 years, in housing prices follow sales with a lag. Housing permits peaked at the beginning of 2022, and starts followed several months later. This morning the FHFA and Case Shiller house price indexes for November showed continued declines from their seasonally adjusted June 2022 peak, and also continued to decline sharply from their YoY growth peak, presaging a similar decline in CPI for shelter by the end of this year. Here is what both look like normed to 100 as of their June peaks: The FHFA index is down -1.0% since then, and the Case Shiller national index down -2.5%. Between June 2020 and

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Housing Prices, New Deal Democrat, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

House price indexes for November: up like a rocket, down like a feather

– by New Deal democrat

As I’ve repeated many times in the past 10 years, in housing prices follow sales with a lag. Housing permits peaked at the beginning of 2022, and starts followed several months later.

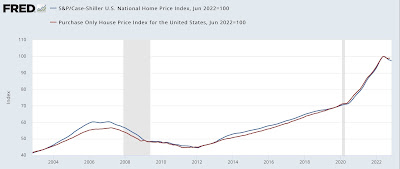

This morning the FHFA and Case Shiller house price indexes for November showed continued declines from their seasonally adjusted June 2022 peak, and also continued to decline sharply from their YoY growth peak, presaging a similar decline in CPI for shelter by the end of this year.

Here is what both look like normed to 100 as of their June peaks:

The FHFA index is down -1.0% since then, and the Case Shiller national index down -2.5%.

Between June 2020 and June 2022, the FHFA index increased by an average of about 1.5% a month! Since June, it has only declined by -0.3% a month. The Case Shiller national index also increased by an average +1.5% a month until June 2022, and has declined an average of -0.5% a month since.

In other words, in the aftermath of the pandemic house prices shot up like a rocket, but to date are only drifting down like a feather.

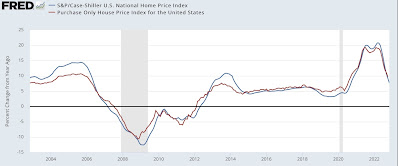

On the other hand, the YoY comparisons are getting much better. At their peaks during spring 2022, both measures of house prices were up about 20% YoY. As of November, the FHFA is down to +8.2% YoY, and the Case Shiller index +7.7% YoY:

At this rate, YoY prices will turn down by sometime this spring.

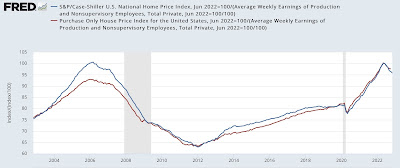

But as measured by households’ ability to make the down payment (leaving mortgage rates aside for this purpose), as shown in the below graph which norms house prices by the average weekly paycheck for nonsupervisory workers, house prices are still close to their all time highs:

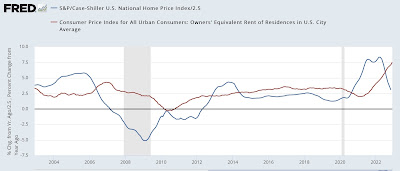

Finally, as I have been emphasizing for over a year, house prices lead the CPI measure of Owners’ Equivalent Rent by 12 or more months. Here is the last 20 year history of the YoY% change in the Case Shiller Index (blue, /2.5 for scale) vs. Owners’ Equivalent Rent YoY (red):

The good news is that, whether we measure with reference to the FHFA or Case Shiller Indexes, the CPI measure for housing is on track to decline to about 3.0%-3.4% YoY by about the end of 2023 – very much within what ought to be the Fed’s comfort range.

The bad news that we probably have a few months to go before the official measure of CPI for shelter peaks, likely at 8.0% or higher. So far the Fed seems to be paying a lot more attention to current OER rather than forward-looking house prices.

House price indexes continue to show the top is in, Angry Bear, New Deal democrat