House prices increase for third straight month, but Case Shiller index now negative YoY – by New Deal democrat Seasonally adjusted house prices through April as measured by both the FHFA (red in the graph below) and Case Shiller (blue) Indexes rose, the former by 0.7% and the latter by 0.5%. This is the third straight increase in a row. Thus house prices have probably bottomed. But on a YoY basis, prices have continued to decelerate sharply, with the FHFA index only up 3.1%, and the Case Shiller index actually showing an outright decline for the first time, down -0.3%: House prices are nevertheless presently increasing at among their lowest YoY rates in the past 25 years. Only during the Great Recession and its aftermath were they lower.

Topics:

NewDealdemocrat considers the following as important: Hot Topics, Housing Prices, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

House prices increase for third straight month, but Case Shiller index now negative YoY

– by New Deal democrat

Seasonally adjusted house prices through April as measured by both the FHFA (red in the graph below) and Case Shiller (blue) Indexes rose, the former by 0.7% and the latter by 0.5%. This is the third straight increase in a row. Thus house prices have probably bottomed. But on a YoY basis, prices have continued to decelerate sharply, with the FHFA index only up 3.1%, and the Case Shiller index actually showing an outright decline for the first time, down -0.3%:

House prices are nevertheless presently increasing at among their lowest YoY rates in the past 25 years. Only during the Great Recession and its aftermath were they lower.

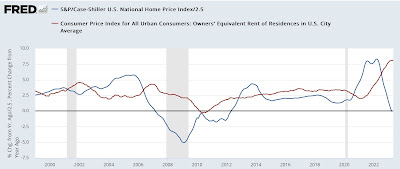

This continues to imply a further deceleration in shelter inflation in the CPI, as shown in the below graph which compares the current Case Shiller reading (/2.5 for scale) with Owners’ Equivalent Rent in the CPI:

The only question in my mind is how long OER remains at its current plateau of +8.0% YoY before it begins to decline sharply. I continue to think we will see shelter inflation in the CPI of only about 2% by the end of next winter.

I will report on new home sales separately later today.

House prices may have bottomed, YoY price increases (leading inflation) have declined, Angry Bear, New Deal democrat