Housing under construction increases back close to record; good economic news, but ammunition for a hawkish Fed – by New Deal democrat Last month I wrote that “the Fed’s sledgehammer attempt via one of the most aggressive rate hike campaigns in its history appears to be on the verge of failure. That’s because housing construction, more than a year after the Fed started its campaign, is not meaningfully cooperating.” This month’s report did not help the Fed, either. With the exception of single family units under construction, every other metric increased, some sharply, and most of April’s data was revised higher. Let’s start with total, single, and multi-family permits. Both total and single family permits continued their increase from

Topics:

NewDealdemocrat considers the following as important: Hot Topics, housing construction, New Deal Democrat, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Housing under construction increases back close to record; good economic news, but ammunition for a hawkish Fed

– by New Deal democrat

Last month I wrote that “the Fed’s sledgehammer attempt via one of the most aggressive rate hike campaigns in its history appears to be on the verge of failure. That’s because housing construction, more than a year after the Fed started its campaign, is not meaningfully cooperating.”

This month’s report did not help the Fed, either. With the exception of single family units under construction, every other metric increased, some sharply, and most of April’s data was revised higher.

Let’s start with total, single, and multi-family permits. Both total and single family permits continued their increase from their January bottoms, while multi-family permits continued their more muted declining trend:

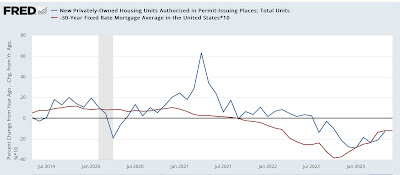

The trend in permits is really not that surprising, since mortgage rates peaked 8 months ago over 7%. Below I show my perennial graph of the respective YoY changes in mortgage interest rates (red, inverted, *10 for scale) and housing permits (blue):

The YoY increase in mortgage rates has been decreasing since last October, and since permits follow interest rates with roughly a 3-6 month lag, the YoY improvement is what we would expect. At the same time, if mortgage rates remain in the 6%-7% range, permits will not continue to improve very much on an absolute scale, and may even retreat somewhat towards their January lows.

Housing starts are much more noisy, and heavily revised. The one big negative revision to April was here, -61,000 downward. But May increased 300,000 annualized from that revision(!):

Both single and multi-unit dwellings participated. Again, because of the aforesaid noise and revision issues, take this with multiple grains of salt.

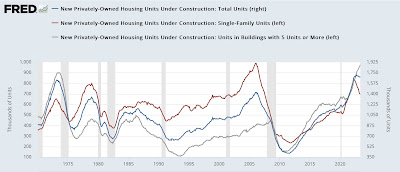

But where the rubber really hits the road, in terms of actual economic activity, is housing units under construction. And here, there were both upward revisions and significant monthly improvement in the total. The one divergence is that single family units under construction declined again, but were overwhelmed by the big increase in multi-family units under construction, which rose to another new all-time high of 978,000 annualized, only -1.2% down from their peak:

Here is the entire 50+ year history of housing under construction, so you can see just how record-breaking the new high in multi-family construction is:

The one big negative is that there has never been such a big (-16%) decline in single family construction (red) without it resulting in a recession. This big a divergence between single and multi-family construction has only happened twice before: in the early 1970s, and the bursting of the 2000s housing bubble.

The objective good news is that it is hard to see a recession developing with construction activity remaining so close to a record. But to the extent this buoys prices (and it almost certainly does, since the improvement in sales will tend to put a bottom on house price declines), the Fed is going to treat this firming as evidence that it needs to remain hawkish, and continue to schedule more interest rate increases.

New housing construction appears to have bottomed; expect further declines in construction employment ahead – Angry Bear, New Deal democrat