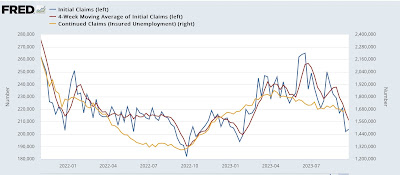

Initial jobless claims remain higher on a YoY basis, but do not suggest near term recession – by New Deal democrat Initial jobless claims rose 2,000 last week to 211,000. The 4 week moving average declined -6,250 to 211,000. With a one week lag, continuing claims rose 42,000 to 1.670 million: Although this appears very strong on an absolute scale, we had a very similar sharp decline to new 50 year lows last September as well, which make me think that there is some unresolved post-pandemic seasonality in play. On the YoY% basis more important for forecasting, initial claims were up 12.1%, the 4 week average up 10.8%, and continuing claims up 29.5%: While this indicates weakness, it does not cross the 12.5% threshold which would suggest

Topics:

NewDealdemocrat considers the following as important: Hot Topics, jobless claims, New Deal Democrat, politics, September 2023, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Initial jobless claims remain higher on a YoY basis, but do not suggest near term recession

– by New Deal democrat

Initial jobless claims rose 2,000 last week to 211,000. The 4 week moving average declined -6,250 to 211,000. With a one week lag, continuing claims rose 42,000 to 1.670 million:

Although this appears very strong on an absolute scale, we had a very similar sharp decline to new 50 year lows last September as well, which make me think that there is some unresolved post-pandemic seasonality in play.

On the YoY% basis more important for forecasting, initial claims were up 12.1%, the 4 week average up 10.8%, and continuing claims up 29.5%:

While this indicates weakness, it does not cross the 12.5% threshold which would suggest a recession is likely.

On a monthly basis, so far in September initial claims are up 10.8%. Since initial claims lead the unemployment rate by several months, this implies that the average unemployment rate by the end of this winter is likely to be approximately 4.0% (i.e., one year ago the average unemployment rate was 3.6%; 3.6*1.108 = 4.0):

Again, this suggests a weakening of the jobs market ahead, but does not yet indicate a recession in the immediate future.

Jobless claims up 14.6%, 4-week average up 11.8%, and continuing claims up 29.6%, Angry Bear, New Deal democrat