Jobless claims end the year on a solidly positive note – by New Deal democrat For our last data of 2023, initial jobless claims remained at a very low level, up 12,000 from one week ago to 218,000. The four week average declined 250 to 212,000. With the usual one week delay, continuing claims rose 14,000 to 1.875 million: On a YoY% basis, initial claims are up only 2.3%, while the more important four week average is up a mere 0.1%. Continuing claims, which have been running higher all year, are still up 15.2%. But this is the lowest comparison since the beginning of April: Finally, since initial claims lead the unemployment rate, and thus lead the “Sahm rule,” the monthly YoY% change in claims for December is only 0.7%, implying

Topics:

NewDealdemocrat considers the following as important: EOY 2023 Jobless Claims, Hot Topics, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Jobless claims end the year on a solidly positive note

– by New Deal democrat

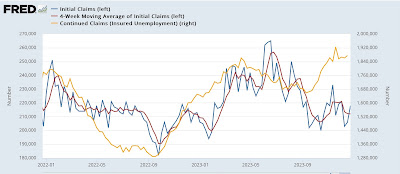

For our last data of 2023, initial jobless claims remained at a very low level, up 12,000 from one week ago to 218,000. The four week average declined 250 to 212,000. With the usual one week delay, continuing claims rose 14,000 to 1.875 million:

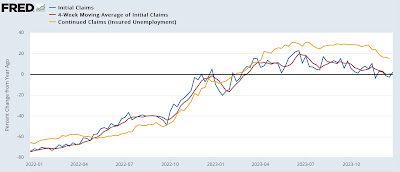

On a YoY% basis, initial claims are up only 2.3%, while the more important four week average is up a mere 0.1%. Continuing claims, which have been running higher all year, are still up 15.2%. But this is the lowest comparison since the beginning of April:

Finally, since initial claims lead the unemployment rate, and thus lead the “Sahm rule,” the monthly YoY% change in claims for December is only 0.7%, implying only a 0.1% increase in the unemployment rate YoY in the months ahead:

Needless to say, none of the YoY metrics above imply the slightest chance of recession in the immediate future.

I’ll have my usual “Weekly Indicators” update this weekend, and I plan on an end-of-year update about the COIVD situation. After that, it is on to a new year of economic data!

“A holly jolly holiday season for initial jobless claims,” Angry Bear, by New Deal Democrat