Very strong initial jobless claims probably the result of unresolved post-pandemic seasonality – by New Deal democrat It continues to be reasonably clear that there is some unresolved post-pandemic seasonality in initial jobless claims, which nose-dived last September and rebounded during October. So far the same pattern is evident this year. To wit, initial claims rose 1,000 last week to 207,000. The more important 4 week moving average declined -2,500 to 208,750. With a one week lag, continuing claims declined -1,000 to 1.664 million: More importantly for forecasting purposes, YoY initial claims were up 4.5%, the 4 week average up 9.4%, and continuing cliams up 27.8%: This is the best YoY showing in several months. On a monthly

Topics:

NewDealdemocrat considers the following as important: Hot Topics, jobless claims, October 2023, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Very strong initial jobless claims probably the result of unresolved post-pandemic seasonality

– by New Deal democrat

It continues to be reasonably clear that there is some unresolved post-pandemic seasonality in initial jobless claims, which nose-dived last September and rebounded during October. So far the same pattern is evident this year.

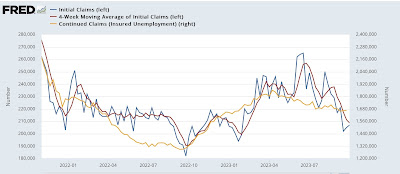

To wit, initial claims rose 1,000 last week to 207,000. The more important 4 week moving average declined -2,500 to 208,750. With a one week lag, continuing claims declined -1,000 to 1.664 million:

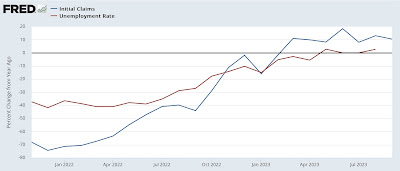

More importantly for forecasting purposes, YoY initial claims were up 4.5%, the 4 week average up 9.4%, and continuing cliams up 27.8%:

This is the best YoY showing in several months.

On a monthly basis, in September initial claims rose 10.4% YoY. Since initial claims lead the unemployment rate by several months, this implies that the average unemployment rate by the end of this winter is likely to be approximately 4.0% (i.e., one year ago the average unemployment rate was 3.6%; 3.6*1.104 = 4.0):

Since the monthly YoY change is the most important comparison, we remain just barely into “yellow caution flag” territory. We’ll see if last year’s seasonal increase in jobless claims in October happens again this year (I think it will).

In the meantime, the implication for tomorrow’s jobs report is that last month’s jump in the unemployment rate from 3.5% to 3.8% is likely largely to “stick.” We might see a decline to 3.7%, but I strongly suspect the months of 3.5% or even 3.4% unemployment rates are over. Additionally, per my writing earlier this week, I am expecting YoY nonsupervisory wage gains to decelerate, and there is every reason to believe the deceleration in jobs gained monthly will decelerate as well, at least on a 3 month average basis.

Initial jobless claims remain higher on a YoY basis, Angry Bear. New Deal democrat