Scenes from the October jobs report: soft landing vs. continued slow deceleration – by New Deal democrat First, an editorial note: economic news is light this week, so don’t be surprised if I play hooky for a day or two. That being said, let’s take a look at the most important trends, as I see them, from Friday’s employment report. The Big Question is, are we having a proverbial “soft landing?” Or is that just an illusory phase on...

Read More »New Deal democrats Weekly Indicators for October 30 – November 3

Weekly Indicators for October 30 – November 3 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. One way I keep track of the producer side of the economy is via the long leading indicator of corporate profits and the short leading indicator of the stock market. As is implied, the former has a long history of leading the latter. Except that the stock market turned down in 2022 before profits did and...

Read More »New Deal democrats Weekly Indicators for October 23 – 27

Weekly Indicators for October 23 – 27 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. With half of reports in, Q3 profits for corporations have made a new all-time high. Meanwhile the stock market has made repeated new 3 month lows. The former is a long leading indicator, the latter a short leading indicator, so we shall see which one proves more accurate. And in case you haven’t noticed at the...

Read More »GDP growth of 4.3% in 3rd Qtr.

Late on the draw here . . . Missed this over the last week. Been too busy doing other things with Angry Bear and looking for a Word Press expert who can help Angry Bear solve some issues. You have to wonder what Fed Chief Jerome Powell is going to do next. If you have been reading New Deal democrat (Richard), it appears we are on the edge of a recession of some type. I am hoping he waits. The returns or values on my funds are decreasing so what...

Read More »Jobless claims continue near expansion lows

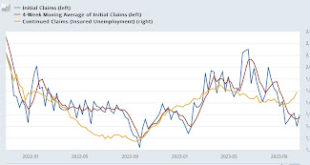

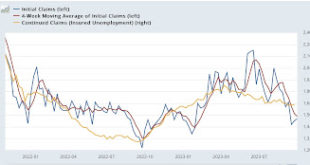

Jobless claims continue near expansion lows – by New Deal democrat Jobless claims continued very low last week, justifying taking down the “yellow caution flag” that had been in place for a number of months. Specifically, weekly new claims rose 10,000 to 210,000 – still a very low historical number. The more important four week moving average increased 1,250 to 207,500. Contrarily with a one-week lag, continuing claims rose sharply, up...

Read More »Why the index of leading indicators failed: examining the once in a lifetime post-pandemic tailwind

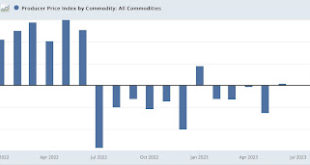

Why the index of leading indicators failed: examining the once in a lifetime post-pandemic tailwind – by New Deal democrat Carl Quintanilla observed the one year anniversary of the following two days ago: I’ve written previously about what confounded that forecast. But let me highlight those issues again. 1. A 40% drop in gas prices, and a generalized 10% drop in commodity prices can do wonders for both producers and consumers. Here’s...

Read More »Real average wages declining, while real aggregate payroll gains remain below peak

Real average wages decline, while real aggregate payroll gains remain below peak – by New Deal democrat With the report on September inflation yesterday, we can update two measures of how well average American workers are doing: real average wages and real aggregate payrolls. Nominally wages increased 0.2% for the month. With consumer prices up 0.4%, real wages declined -0.2%: Real wages had been in an increasing trend since gas prices...

Read More »Pure, unadulterated evil is unleashed on this world

One has to ask how we have reached this point in the Middle East. There are many actions taken which have maligned Palestinians and Arabs. If we allow the Gaza to be abandoned by Palestinians due to terrorists, who follows? This sounds too much like the growth of Israel at the expense of the Palestinians. The West Bank is being partitioned as more Israelis migrate to it from Israel. When it comes to Israel, the US is too weak-kneed to do much about...

Read More »September producer prices confirm economic tailwind has ended

September producer prices confirm economic tailwind has ended – by New Deal democrat My strong suspicion has been that the tailwind of declining commodity prices, typified by the big decline in gas prices in late 2022 is what allowed the US economy to grow so well so far this year, blunting the effects of major Fed interest rate hikes. For the last several months, my focus has been whether that decline is over. This morning’s producer price...

Read More »Very strong initial jobless claims probably the result of unresolved post-pandemic seasonality

Very strong initial jobless claims probably the result of unresolved post-pandemic seasonality – by New Deal democrat It continues to be reasonably clear that there is some unresolved post-pandemic seasonality in initial jobless claims, which nose-dived last September and rebounded during October. So far the same pattern is evident this year. To wit, initial claims rose 1,000 last week to 207,000. The more important 4 week moving average...

Read More » Heterodox

Heterodox