A comment on Juneteenth; and what I’ll be looking for in tomorrow’s housing report – by New Deal democrat That Juneteenth is a national holiday ought to be a full rebuttal to those who think that teaching the entirety of American history, including its worst moments, is somehow an insult to the majority. That enslavement was finally ended by the Emancipation Proclamation and the 13th Amendment is something that all present-day Americans ought to be able to look back on as worth celebrating. We are *all* better for it, not just some of us. Needless to say, no economic news today, but tomorrow we will get the very important housing permits, starts, and construction data for May. I will be particularly paying attention to how much housing is

Topics:

NewDealdemocrat considers the following as important: Economic News, Hot Topics, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

A comment on Juneteenth; and what I’ll be looking for in tomorrow’s housing report

– by New Deal democrat

That Juneteenth is a national holiday ought to be a full rebuttal to those who think that teaching the entirety of American history, including its worst moments, is somehow an insult to the majority. That enslavement was finally ended by the Emancipation Proclamation and the 13th Amendment is something that all present-day Americans ought to be able to look back on as worth celebrating. We are *all* better for it, not just some of us.

Needless to say, no economic news today, but tomorrow we will get the very important housing permits, starts, and construction data for May. I will be particularly paying attention to how much housing is under construction. As I’ve mentioned before, this is the measure of the *actual* current economic activity in the housing market.

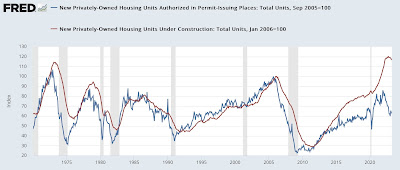

What has been most interesting is how much the original pandemic-relating bottleneck in housing construction supplies has continued to affect the market. To show you that, below is a graph of housing permits (blue) vs. housing units under construction (red). I’ve normed both to 100 as of their respective peak months during the housing bubble of almost two decades ago:

Construction follows permits, but I wanted to point out a few more details.

First of all, note that the current peak in construction is far higher relative to the equivalent peak in permits compared with any of the past peaks over the last 50+ years. Permits didn’t just surge post-pandemic, but they remained at sharply higher levels for over 18 months, in contrast with the peaks in the 1970s, 1990s, and 2000s, which lasted less than 12 months. The significant similarity, which I’ll discuss in a little more detail below, is the mid-1980s. Thus there was much more “pent-up” permitted activity in the past several years than during most of the previous housing booms since 1970.

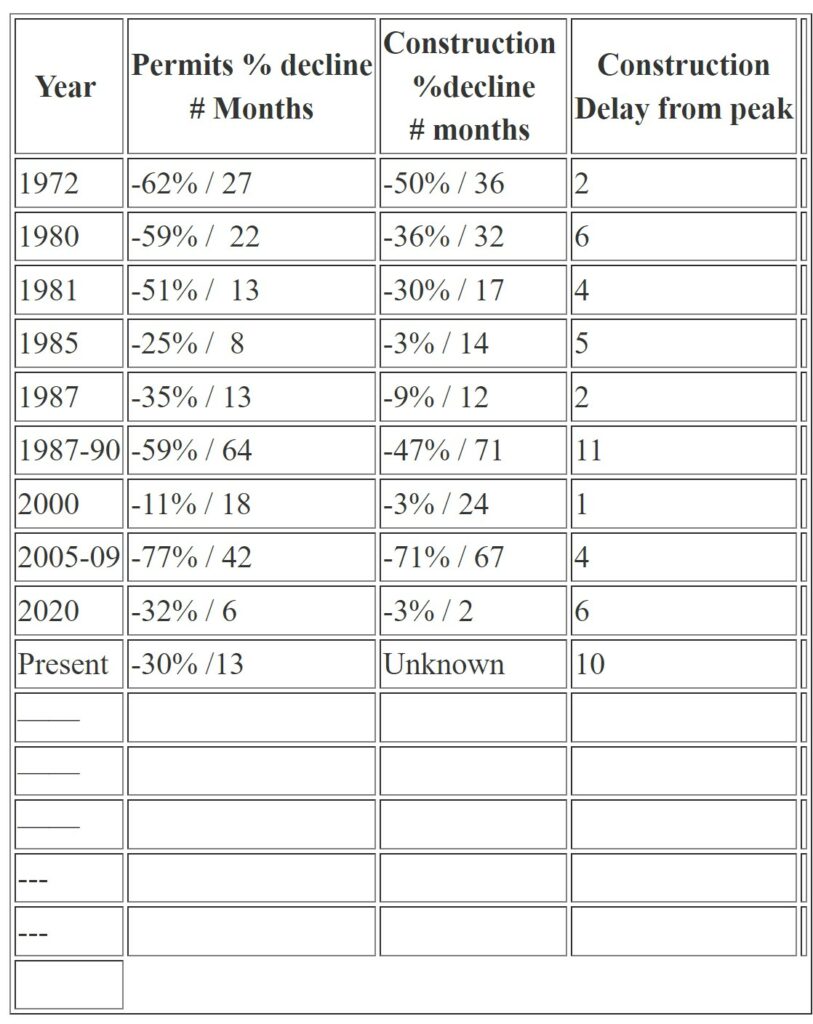

Further, norming a peak in both metrics to the same value helps show that construction never falls quite as much as permits during the downturns. And although this is harder to make out, construction ramps up very quickly in upturns, but turns down more slowly during downturns. I show this below in the following chart:

Construction has usually peaked 4 to 6 months after permits, with the notable exceptions of the 1980s and the present. But the downturn in construction has normally taken about 25%-40% longer than permits to reach bottom. And the total downturn in construction has typically been between 50%-75% of the downturn in permits. In the case of the 1980s, an initial downturn of about 25% in permits only resulted in a downturn of -3% in construction. As the downturn in permits gradually continued during the rest of the decade, so did the gradual downturn in construction. Only about 6 years after the initial downturn did a recession occur.(and both the resilience of the economy in the mid to late 1980s and the downturn in 1990 had very much to do with the collapse of OPEC pricing power, and the effect on oil prices of the Iraqi invasion of Kuwait).

If mortgage rates do not make new highs, but hover in the 6%-7% range in the near future, I expect housing permits and starts to level off as well, a trend that almost certainly has already started. Like the 1980s, this will probably result is a slow continued decline in housing under construction. The current decline in permits probably means something like an ultimate 10%-20% decline in construction, which won’t be manifest until sometime in the early part of next year. Note that with the sole exception of 2001 just-barely-a-recession, and the 2 month pandemic downturn, all the other recessions in the past 50+ years featured downturns of over 50% in permits and over 30% in construction.

Tomorrow, I will be looking to see if the data is consistent with this scenario.

Housing update: sales have bottomed, prices in process, Angry Bear , New Deal democrat