Both manufacturing and construction continue to contract – by New Deal democrat As usual, we start the month with data on last month’s manufacturing activity, and the previous month’s construction activity. This month, both were negative. The ISM manufacturing index, which has had an excellent record as a leading indicator for the past 75 years, declined to 46.3, its lowest level since the pandemic recovery began. The new orders index, which is the best leading component, also declined to 44.3, above only December’s 42.5 low: According to the ISM, levels below 48 have historically been consistent with recessions. Needless to say, that’s what the index says about manufacturing now (and consistent with what the new orders indexes of the

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Both manufacturing and construction continue to contract

– by New Deal democrat

As usual, we start the month with data on last month’s manufacturing activity, and the previous month’s construction activity. This month, both were negative.

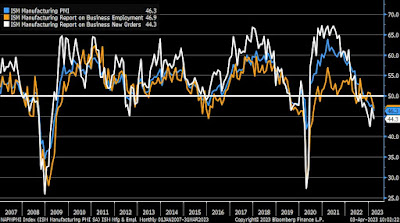

The ISM manufacturing index, which has had an excellent record as a leading indicator for the past 75 years, declined to 46.3, its lowest level since the pandemic recovery began. The new orders index, which is the best leading component, also declined to 44.3, above only December’s 42.5 low:

According to the ISM, levels below 48 have historically been consistent with recessions. Needless to say, that’s what the index says about manufacturing now (and consistent with what the new orders indexes of the regional Feds have been saying for months).

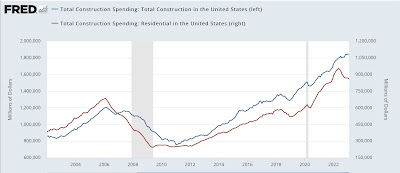

February total and residential construction spending also both declined, the former by -0.1%, the latter by -0.6%. Total construction spending, the laggard of the two, appears to be peaking, as it has only increased 0.2% since last November. Residential construction spending, the most leading component, may be bottoming out, as it has only declined -0.8% since November:

Since these are nominal readings, I have been deflating them by the special PPI for construction materials, which declined sharply between last May and December, but has risen in the two months since. Here’s what the deflated numbers look like:

In real terms, both have turned down, and the leading residential number has been declining almost consistently for a year.

In short, both leading sectors of manufacturing and construction are likely in contraction.

October Manufacturing (near record low) and Construction Decline, Angry Bear, New Deal democrat