There is now only one significant manufacturing datapoint that is not flat or down – but it’s the one the NBER relies upon – by New Deal democrat I am increasingly of the opinion that at the moment, the only two economic data series that are important are nonfarm payrolls and the personal consumption expenditure deflator. That’s because almost every other important metric of the economy is either flat or declining. But payrolls keep chugging along (as evidenced by yesterday’s initial claims report showing that layoffs are figuratively non-existent). And the PCE deflator, which covers a broader spectrum than the CPI, keeps helping two coincident indicators important to the NBER, namely real personal income and real manufacturing and trade sales,

Topics:

NewDealdemocrat considers the following as important: Hot Topics, NonFarm payrolls, Personal Consumption, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

There is now only one significant manufacturing datapoint that is not flat or down – but it’s the one the NBER relies upon

– by New Deal democrat

I am increasingly of the opinion that at the moment, the only two economic data series that are important are nonfarm payrolls and the personal consumption expenditure deflator. That’s because almost every other important metric of the economy is either flat or declining. But payrolls keep chugging along (as evidenced by yesterday’s initial claims report showing that layoffs are figuratively non-existent). And the PCE deflator, which covers a broader spectrum than the CPI, keeps helping two coincident indicators important to the NBER, namely real personal income and real manufacturing and trade sales, remain in the plus column.

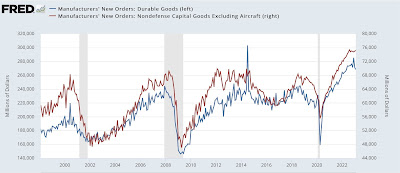

This morning’s report on manufacturers’ new orders for durable goods for February is evidence of that. The broad measure (blue in the graphs below) declined just shy of 1%, while the core measure (red), which is less noisy, increased by 0.2%:

Both are below their peaks in December and August 2022, respectively. In the past few months the broad measure has been trending down, while the core measure has been basically flat.

New orders for durable goods have long been recognized as a leading indicator. Here’s the longer term view for the past 25 years:

Their record certainly isn’t perfect. The core measure continued to rise well into the Great Recession, and both declined sharply in the industrial recession of 2015-16 (that was not an actual recession because consumers kept spending merrily away, and so employment kept rising as well).

Anyway, in the below graph I’ve also added the value of manufacturers total actual shipments, and shipments for “core” capital goods, as well as *nominal* manufacturers’ sales, all normed to 100 as of October 2022:

The slowdown in growth, followed by an actual downturn in the broad measures of orders and shipments, is apparent, as is the flattening in both “core” measures, up only 0.1% and 0.2% since October, respectively.

Nominally, manufacturers sales (gold) through January are also down -0.8% since October. This is where the PCE deflator comes in. Because while there is no breakout of “real” manufacturers sales only, real manufacturing and trade sales (which also includes wholesale and retail sales, and is relied upon by the NBER) was up 0.6% as of its last reading in December.

In other words, the entire panoply of goods production and distribution in the US economy (including industrial production as well) is either flat or down – with the exception of those two measures (real personal income and real manufacturing and trade sales) which take into account the big deflation in producer prices since June, and the PCE deflator. More on that next week, as we wait for the February PCE report next Friday.

Real average wages and aggregate payrolls for nonsupervisory workers through January, Angry Bear, New Deal democrat