March real retail sales lay an egg, suggests downturn in nonfarm payrolls by the end of summer – by New Deal democrat After a quiet early part of the week, today we get a deluge of data: retail sales and industrial production for March, and total business sales for February. Because real total business sales are one of the 4 big coincident indicators tracked by the NBER, and because retail sales are about 1/3rd of the total, and industrial production helps us estimate the rest, after the data comes out I can give estimates of the *real,* not just nominal, values for both February and March. But first, retail sales . . . Which laid an egg, as they do once or twice a year. In this case nominal retail sales declined -1.0% for the month.

Topics:

NewDealdemocrat considers the following as important: Hot Topics, March 2023, Retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

March real retail sales lay an egg, suggests downturn in nonfarm payrolls by the end of summer

– by New Deal democrat

After a quiet early part of the week, today we get a deluge of data: retail sales and industrial production for March, and total business sales for February. Because real total business sales are one of the 4 big coincident indicators tracked by the NBER, and because retail sales are about 1/3rd of the total, and industrial production helps us estimate the rest, after the data comes out I can give estimates of the *real,* not just nominal, values for both February and March.

But first, retail sales . . . Which laid an egg, as they do once or twice a year.

In this case nominal retail sales declined -1.0% for the month. Because consumer prices increased less than 0.1% in March, real retail sales also were down -1.0%. Combined with a -0.6% decline in February, real retail sales have taken back close to 2/3’s of the big January gain, and are down -3.0% from their March 2021 peak:

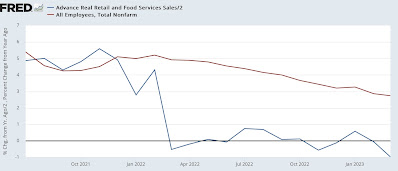

YoY real retail sales are down -1.9%, the biggest decline since the pandemic lockdown. As I write nearly every month, they are a noisy but time-tested short leading indicator (/2) for jobs. Here is the updated look at that comparison:

YoY nonfarm payrolls have declined about 1/3rd, from +4% to +2.7% in the past 6 months. At this rate they will have declined by more than 1/2 of that +4% in 3 or 4 months, which by my rule of thumb means it is likely there will be a seasonally adjusted actual decline in monthly payrolls by the end of this summer.

UPDATE: Checking the historical record all the way back to 1948, a YoY decline in real retail sales of -1.9%, our current value, has *always* occurred at the outset of or during a recession with the only exceptions of 1951-52, and the months of September 1987 and October 2002.

Despite sharp rebounds in retail sales and manufacturing production, both metrics are on the cusp of being recessionary, Angry Bear, New Deal democrat