Two year low in new home prices and turndown in sales show renewed pressure caused by increased mortgage rates – by New Deal democrat Once again, this morning’s report on new single family home sales shows that the compete bifurcation of the new vs. existing home markets continues. Unlike existing homeowners, many of whom are shackled in place by 3% mortgages, new home builders can offer price incentives and downsize floor plans to increase sales. This morning’s report also shows once again that this data is very volatile and heavily revised. September new home sales (blue in the graph below, left scale), which had been reported at a 12 month high of 759,000 annualized, were revised downward by -40,000 to 719,000. And October sales were

Topics:

NewDealdemocrat considers the following as important: Hot Topics, mortgage rates, New Deal Democrat, new home sales and prices, Novemner 2023, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Two year low in new home prices and turndown in sales show renewed pressure caused by increased mortgage rates

– by New Deal democrat

Once again, this morning’s report on new single family home sales shows that the compete bifurcation of the new vs. existing home markets continues. Unlike existing homeowners, many of whom are shackled in place by 3% mortgages, new home builders can offer price incentives and downsize floor plans to increase sales. This morning’s report also shows once again that this data is very volatile and heavily revised.

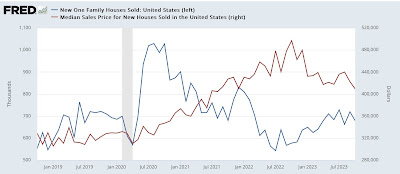

September new home sales (blue in the graph below, left scale), which had been reported at a 12 month high of 759,000 annualized, were revised downward by -40,000 to 719,000. And October sales were reported at 679,000, close to a 6 month low. Meanwhile prices (red, right scale) declined to a 2 year low of $409,300:

This also yet again demonstrates my mantra that prices follow sales, in this case with a 2 year delay from summer 2020 to summer 2022.

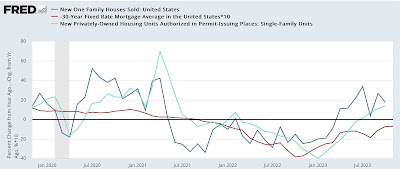

And since sales follow mortgage rates, here is an update of that relationship, comparing the YoY change in mortgage rates (red, inverted, *10 for scale) vs. the YoY% change in new home sales (blue) and single family permits (light blue):

As mortgage rates rose sharply in 2022, permits and sales sank. Mortgage rates moderated throughout early 2023, and both sales and permits responded positively. Indeed, on a YoY basis new home sales are up 17.7% (while prices, as shown in the first graph above are down -17.6%). But in the last 6 months, mortgage rates rose to new highs, and new home sales – usually the first metric to turn – have already responded negatively. Permits are likely to follow shortly.

Averaged together, new and existing home sales combined are down in the aggregate since one year ago, and so are prices. I expect further pressure on both sales and prices in the months to come.

Existing homeowners with 3% mortgages remain frozen in place, as sales fall to a new 28 year low, Angry Bear, New Deal democrat