Pent-up demand and sales: an update – by New Deal democrat There’s no big economic news today. So while we wait to see if initial jobless claims continue to worsen tomorrow, and what happens with real personal spending and income, as well as real business sales on Friday, let me point you to an updated detailed discussion of why the Fed’s rate hikes haven’t yet caused the economy to turn down (hint: gas prices plus pent-up demand in several crucial sectors), at Seeking Alpha. Additionally, as I discuss in that article, the evidence is simply compelling that leading manufacturing indicators do not have the importance that they used to before the “China shock,” i.e., the offshoring of much of the previous US-based manufacturing to China

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Pent-up demand and sales: an update

– by New Deal democrat

There’s no big economic news today.

So while we wait to see if initial jobless claims continue to worsen tomorrow, and what happens with real personal spending and income, as well as real business sales on Friday, let me point you to an updated detailed discussion of why the Fed’s rate hikes haven’t yet caused the economy to turn down (hint: gas prices plus pent-up demand in several crucial sectors), at Seeking Alpha.

Additionally, as I discuss in that article, the evidence is simply compelling that leading manufacturing indicators do not have the importance that they used to before the “China shock,” i.e., the offshoring of much of the previous US-based manufacturing to China that began almost 25 years ago.

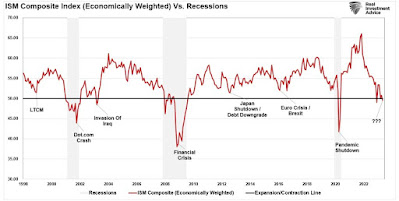

This means that consumption, which is about 70% of the entire economy, has assumed greater importance. Lance Roberts (whose economic analysis I usually find facile and ideologically motivated) nevertheless deserves credit for positing that an economically weighted average of the ISM manufacturing and non-manufacturing index is now more useful. And here it is:

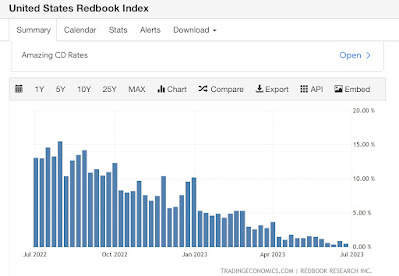

On that same subject, I’ve been watching the weekly update of Redbook’s consumer spending measure like a hawk since at least the beginning of this year, because it has strongly suggested that consumer spending on goods peaked probably late last year. Because it is a nominal index, it doesn’t account for inflation, but nevertheless I’ve been waiting for it to cross the zero threshold. It’s been like watching paint dry, and it continues to tantalize:

The last 4 weeks have all seen YoY readings of less than 1%. The average is presently +0.6%.

We’ll get a much more complete picture, updated through May, on Friday.

Real final sales and inventories as portents of recession, Angry Bear, New Deal democrat