With sales near 25 year lows, the huge divergence between the existing and new home markets continues – by New Deal democrat The drastic bifurcation between the new and existing home markets continues. Existing home sales fell to 4.04 million annualized in August, the lowest level of the entire past 10+ years except for last December and January. In fact, with the additional exception of a number of months during the great home bust during and right after the Great Recession, it’s the lowest level of the past *25* years: This is a market that is in utter collapse, down about 40% from its peak several years ago. The reason for the collapse, as I have noted several times in the past few months, is that existing homeowners are essentially

Topics:

NewDealdemocrat considers the following as important: Hot Topics, new and existing home sales, New Deal Democrat, September 2023, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

With sales near 25 year lows, the huge divergence between the existing and new home markets continues

– by New Deal democrat

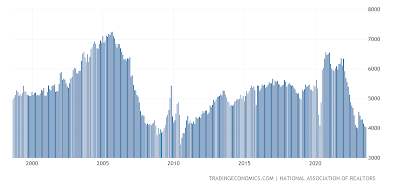

The drastic bifurcation between the new and existing home markets continues. Existing home sales fell to 4.04 million annualized in August, the lowest level of the entire past 10+ years except for last December and January. In fact, with the additional exception of a number of months during the great home bust during and right after the Great Recession, it’s the lowest level of the past *25* years:

This is a market that is in utter collapse, down about 40% from its peak several years ago.

The reason for the collapse, as I have noted several times in the past few months, is that existing homeowners are essentially locked in place by their 3% original or refinanced mortgages. They’re not selling, and they’re not going anywhere in the foreseeable future. Such houses as are on the market are disproportionately from people who have no mortgages, and so are insensitive to those rates.

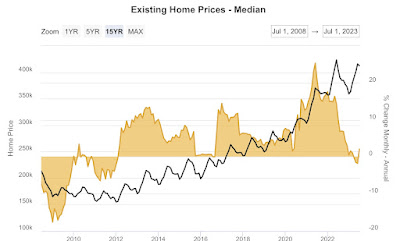

With inventory so restricted, prices have held firm. Indeed, the median price was above $400,000 for the third month in a row (blue line). It is at $407,100, and is up YoY for the second month in a row (shaded gold area), at +3.9%:

All of this has been driving buyers to the new home market, where builders have been cutting prices and engaging in other incentives, and in particular the less expensive multi-family units, which made continual new records until their very slight decline this month, as I pointed out a couple of days ago.

To show you the contrast, here is a graph of the YoY% change in new home prices (red, left scale) compared with new home sales (blue, right scale):

The median price of a new home is down -8.7% YoY. The number sold remains higher than at any point in the last expansion except for four months in 2019.

So long as the Fed keeps interest rates elevated, I do not see this changing anytime soon.

Unlike homeowners, home builders can alter their product and pricing point, Angry Bear, New Deal democrat