Scenes from the leading sectors of the November jobs report: why I sounded a note of caution – by New Deal democrat I seem to have been something of a negative outlier with respect to last Friday’s jobs report. Not because I was downbeat – although I said there were “warning signs of weakness,” but almost all the other commentary I have seen was upbeat.So today let’s take a look at the leading sectors in the jobs report, to show why I sounded a note of caution. Let’s start with the manufacturing workweek, which is one of the 10 official components of the Index of Leading Indicators. It typically has turned down in the past even before manufacturing employment itself does. Here’s its record from the end of WW2 almost 80 years ago:

Topics:

NewDealdemocrat considers the following as important: 2023, Hot Topics, November jobs report, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Scenes from the leading sectors of the November jobs report: why I sounded a note of caution

– by New Deal democrat

I seem to have been something of a negative outlier with respect to last Friday’s jobs report. Not because I was downbeat – although I said there were “warning signs of weakness,” but almost all the other commentary I have seen was upbeat.

So today let’s take a look at the leading sectors in the jobs report, to show why I sounded a note of caution.

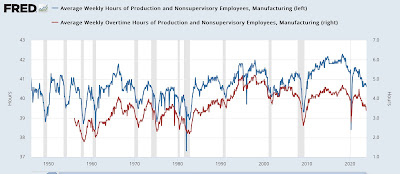

Let’s start with the manufacturing workweek, which is one of the 10 official components of the Index of Leading Indicators. It typically has turned down in the past even before manufacturing employment itself does. Here’s its record from the end of WW2 almost 80 years ago:

Almost always (exceptions 1966, 1985, and 1995) when manufacturing hours and overtime have declined more than by -.05 hours, a recession has followed. In the past 18 months, hours have declined by -0.9 hours, and overtime has declined by -1.1 hours.

Next, here is the long term look at manufacturing employment up until the “China shock” began in 2000:

With rare exception (twice in the 1950s plus 1981), manufacturing employment turned down before a recession began.

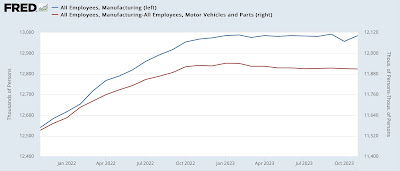

Here’s the recent record, also splitting out motor vehicle manufacturing, which has benefited from the unlinking of the supply chain:

In total, manufacturing employment has been close to unchanged for a year. Excluding motor vehicle employment, it has declined slightly.

But as I’ve written recently, manufacturing plays less of a role in the US economic cycle than it used to. So let’s look at other sectors as well.

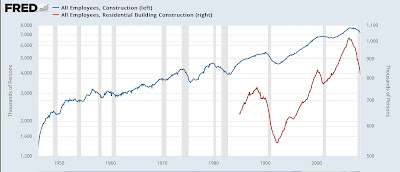

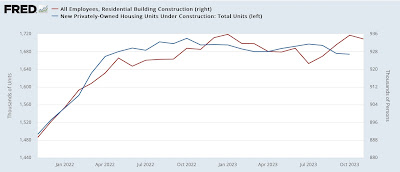

Another jobs sector that has always turned at least flat in advance of a recessions is construction, and residential building construction has always declined:

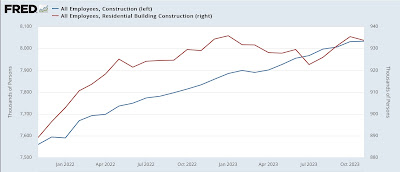

Residential building construction employment has been flat for almost a year, while general construction employment (aided by the restoring of manufacturing capacity) has continued to increase:

Typically residential construction employment has coincided with the number of residential units under construction, and it has done so this year as well:

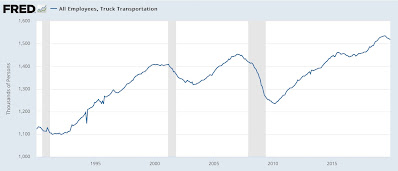

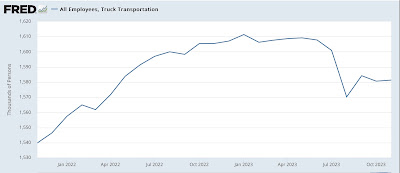

Another leading sector of employment has been truck transportation, which with the exception of 2000 has also turned down in advance of recessions:

It has turned down as well in the past half year:

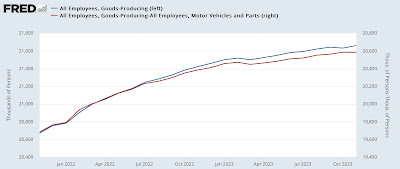

All of the above are generally in the “goods” rather than “services” employment sector. Goods employment has generally flattened, and occasionally declined in advance of recessions:

It is still increasing, although at a more subdued rate this year:

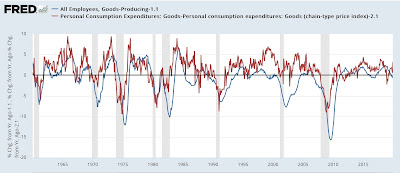

Last week I discussed the importance of real spending on goods, noting that it led employment. On a YoY basis, real goods spending is up 2.1%, while goods employment is up 1.1%. The below graph norms both values to zero, to show how they compare historically:

Both real spending on goods and goods employment are actually weak on a historical basis, but both are consistent with a number of slowdowns that did not turn into recessions in the past.

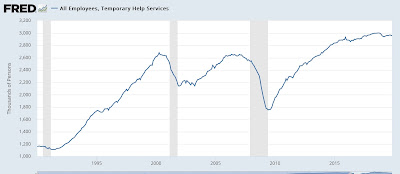

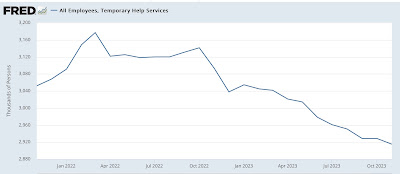

There is also at least one services segment which has also historically been leading: temporary help services:

These have declined sharply in the past year:

Finally, although they are not a leading sector, I noted in my report Friday that professional and business employment is down, and is virtually unchanged YoY. These are well paying jobs that are the backbone of the affluent portion of the middle class. They have never been at this level YoY without a recession occurring:

In summary, we have several sectors – the manufacturing work week, temporary help, professional and business jobs, and truck transportation – that are consistent with an oncoming recession right now. There are several others – manufacturing and residential construction – which are flat, but have not turned down as they frequently have in advance of recessions. And finally, there are several sectors – overall construction and goods production – which are in expansion mode.

As I wrote in the context of the personal income and spending report last week, with interest rates still elevated, I am paying particular attention to real spending on goods, as a short leading harbinger for whether weakness will spread further into the economy.

November jobs report: signs of considerable strength, but warning signs of considerable weakness as well, Angry Bear, New Deal democrat.