Except for fictitious shelter and vehicle repairs, September inflation was moderate – by New Deal democrat With the main exception of fictitious shelter, consumer inflation in September remained relatively subdued, but as anticipated has stopped decelerating. First I’ll look at the headlines, then the problem children. Total inflation (blue in the graph below) rose 0.4% for the month, but only 0.3% less food and energy (red). Less shelter (gold) it rose only 0.1%: On a YoY basis, total inflation was up 3.7%, core inflation up 4.1%, and ex-shelter up 2.0%: In other words, as I have been saying all this year, since shelter makes up 1/3rd of the total index, and 40% of core, almost all of the elevated core and total readings can be

Topics:

NewDealdemocrat considers the following as important: Hot Topics, inflation, politics, September 2023, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Except for fictitious shelter and vehicle repairs, September inflation was moderate

– by New Deal democrat

With the main exception of fictitious shelter, consumer inflation in September remained relatively subdued, but as anticipated has stopped decelerating. First I’ll look at the headlines, then the problem children.

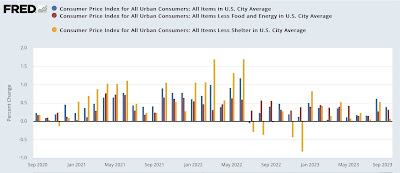

Total inflation (blue in the graph below) rose 0.4% for the month, but only 0.3% less food and energy (red). Less shelter (gold) it rose only 0.1%:

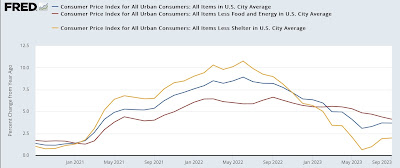

On a YoY basis, total inflation was up 3.7%, core inflation up 4.1%, and ex-shelter up 2.0%:

In other words, as I have been saying all this year, since shelter makes up 1/3rd of the total index, and 40% of core, almost all of the elevated core and total readings can be attributed to fictitious shelter.

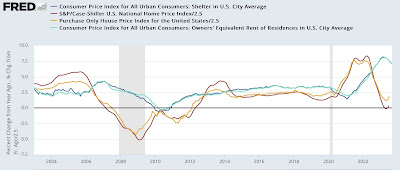

Shelter itself rose 0.6% in September, “hot” compared with the last few months, although below its monthly readings one year ago:

More importantly, here’s my update of shelter (blue) and OER (light blue) YoY vs. the Case Shiller (red) and FHFA (gold) house price indexes:

OER and shelter generally took longer than house prices to rise to peak, and appear to be taking a similarly leisurely trip back down – but back down they will continue to go for roughly the next 12 months.

As an aside, here is the latest national rent report from Apartment List, showing a YoY decline of -1.2%:

Aside from shelter, the *only* categories up 4.0% or higher YoY were food away from home (restaurants), up 6.0%, and transportation services (auto insurance and repairs), up 9.1%.

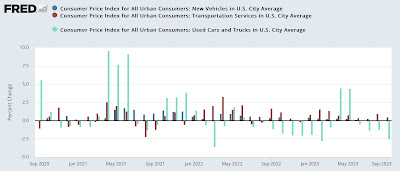

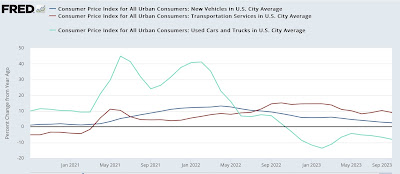

New vehicle prices rose 0.3% in September, and used vehicle prices continued their cliff-diving, down -3.0%. But transportation services rose 0.7%:

On a YoY basis, new vehicles are now only up 2.5%, and used vehicles are *down* -8.0%. But transportation services are up 9.1%:

The story here is that repair parts cost more than they did before vehicle prices shot up, so insurance prices have had to increase sharply as well. Meanwhile many millions of owners are compensating by holding on to their older vehicles longer. These older vehicles need more, and more costly, repairs, driving those prices higher as well.

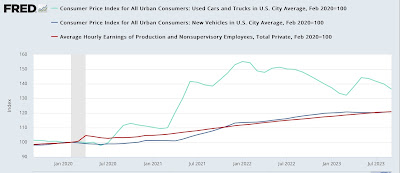

Nonsupervisory wages have actually kept up with new car prices since the pandemic began, but used car prices are still about 16% higher in real terms:

Basically, since I sharply discount fictitious shelter, with the exception of new vehicles, insurance, and repairs, the inflation news in September was benign.

Consumers will probably nevertheless continue to decry inflation, because their mortgage and monthly car payments remain sky high compared with the last decade.

Why the public still views inflation as a major problem, despite the official numbers, Angry Bear, New Deal democrat.