September JOLTS report shows continued deceleration in all trends – except layoffs – by New Deal democrat All of the major metrics in last month’s JOLTS report for August improved, most slightly, but the decelerating trend continued. In this morning’s report for September, that trend continued, as most of the metrics improved or declined very slightly, but the trends remained intact. Here are openings (blue), hires (red), and voluntary quits (gold), all normed to 100 just before the pandemic: As can be easily seen, for all intents and purposes both hiring and quitting are back to where they were in normal times before the pandemic, while openings – which are always suspect because many companies keep fictitious openings posted as a matter

Topics:

NewDealdemocrat considers the following as important: 2023, Healthcare, New Deal Democrat, September JOLTS, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

September JOLTS report shows continued deceleration in all trends – except layoffs

– by New Deal democrat

All of the major metrics in last month’s JOLTS report for August improved, most slightly, but the decelerating trend continued. In this morning’s report for September, that trend continued, as most of the metrics improved or declined very slightly, but the trends remained intact.

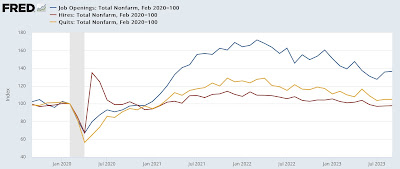

Here are openings (blue), hires (red), and voluntary quits (gold), all normed to 100 just before the pandemic:

As can be easily seen, for all intents and purposes both hiring and quitting are back to where they were in normal times before the pandemic, while openings – which are always suspect because many companies keep fictitious openings posted as a matter of routine – remain very elevated, at 36% higher. But all are in persistent downtrends.

The one exception this month was a sharp downturn in layoffs and discharges by -165,000 to 1.517 million, the lowest level since last December. This is in accord with the big September decline in initial jobless claims. As with the above graph, this one is also normed to its average right before the pandemic, showing that layoffs remain well below that level (further evidence of labor market tightness):

It’s possible this was affected by anticipation of the UAW strike. We’ll see next month. For the moment, though, this does break the upward trend in layoffs.

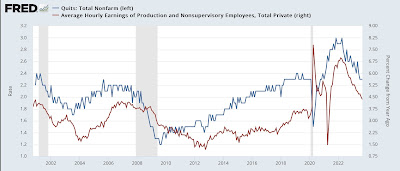

Finally, two months ago I premiered a comparison of the quits rate and average hourly earnings. This is because the former has a 20+ year history of leading the latter, which I have in the past described as a “long lagging” indicator that turns well after the turns in most other metrics. Here’s the update of that comparison:

The quits rate was unchanged in September, but as with the other JOLTS metrics, the downward trend remains fully intact. Thus on Friday we can expect to see a continuation of the trend in decelerating YoY wage gains, at or below 4.5%.

August JOLTS report: a pause in deceleration, but the trend remains intact, Angry Bear, New Deal democrat