– by New Deal democrat This morning, I pointed out that manufacturing production is -1.8% below its 2022 high and may be in a slightly declining trend. Which means that added attention has to be paid to whether the other leading production sector, construction, is holding up. Instead, this morning brought the first sustained evidence that housing units under construction, the “real” economic measure of the residential building sector, which had been levitating at or near its post-pandemic high for over a year, has finally turned down. To cut to the chase, housing units under construction declined -1.4% in April, after a -1.1% decline in March. It is now -5.6% below its October 2022 peak (single family and multi-unit numbers also shown):

Topics:

NewDealdemocrat considers the following as important: April Housing 2024, Hot Topics, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

– by New Deal democrat

This morning, I pointed out that manufacturing production is -1.8% below its 2022 high and may be in a slightly declining trend. Which means that added attention has to be paid to whether the other leading production sector, construction, is holding up.

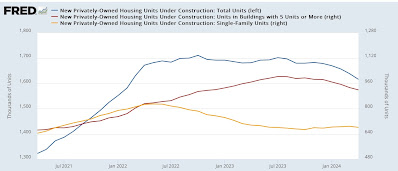

Instead, this morning brought the first sustained evidence that housing units under construction, the “real” economic measure of the residential building sector, which had been levitating at or near its post-pandemic high for over a year, has finally turned down.

To cut to the chase, housing units under construction declined -1.4% in April, after a -1.1% decline in March. It is now -5.6% below its October 2022 peak (single family and multi-unit numbers also shown):

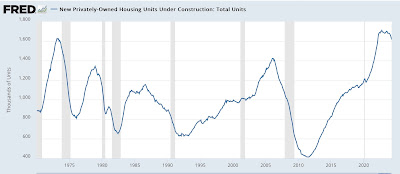

In the past, it has typically taken a -10% decline or more before the onset of a recession. After a minor decline in 2023, in the past four months the increased pace of decline has taken us over half the way to that mark:

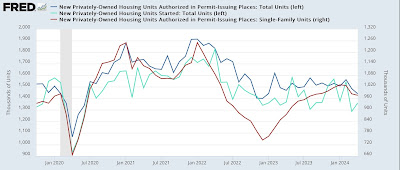

Earlier this year, while noting that I expected to see more of a decline in the actual hard-data metric of housing units under construction, I wrote that “With permits having increased off their bottom, I am not expecting such a 10% decline in construction to materialize.” Here’s the updated look.

Below I show total permits (dark blue) compared with the much more volatile and slightly less leading total starts (light blue) and also compared with single family permits (red, right scale) which are the most leading and least volatile of all:

Starts rose a sharp 5.7% for the month, while total permits declined -1.0% and single family permits declined -0.8%. The dip in total and single family permits in the past two months has taken us back to January 2023 levels, between -20%-25% below that peak. Historically it has taken more than a -30% decline, or even a -40% decline, before a recession has begun:

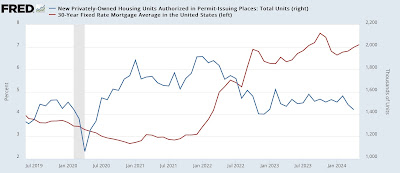

April’s decline in permits in turn was most likely caused by the increase in mortgage rates back above 7%. As per usual, mortgage rates lead permits:

Importantly, it’s worth noting that even so, we have not seen mortgage rates anywhere near last October’s 7.79% peak.

My sense is that, while housing units under construction will decline further, unless interest rates increase further, permits and starts will stabilize, and after a period so while units under construction, without crossing into recession warning territory.

At the same time, this is the most negative housing construction report since the end of 2022, when there were a lot of other signals that suggested a recession might be very close.

To return to my opening comment, this year I am paying extra close attention to the manufacturing and construction sectors, because a significant turndown in both of those simultaneously would be a danger signal for oncoming recession. This morning we did get reports showing declines in both. Only one month, but these are the two most negative economic reports of this entire year so far.

March housing: permits and starts – don’t get too excited, Angry Bear by New Deal democrat