Job and Wage Growth Surge in January Center for Economic and Policy Research, Dean Baker I believe this report by Dean Baker to be a bit premature. If you are keeping up with New Deal democrat, he cites reasons why this still can go either way at this point. One reason is the Fed’s foot still on the brake. Another is manufacturing workweek is practically screaming “recession.” And U6 underemployment rate increased again. We could be near the end and on our way to a better economy. However high Fed Rates translate to higher mortgage rates. Something else to thing about. ~~~~~~~~ The January jobs report removed any immediate concerns about a weakening labor market as the economy added 353,000 jobs. In addition, the December figure was

Topics:

Angry Bear considers the following as important: 2024, Hot Topics, Jobs and Wages, politics, US EConomics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Job and Wage Growth Surge in January

Center for Economic and Policy Research, Dean Baker

I believe this report by Dean Baker to be a bit premature. If you are keeping up with New Deal democrat, he cites reasons why this still can go either way at this point. One reason is the Fed’s foot still on the brake. Another is manufacturing workweek is practically screaming “recession.” And U6 underemployment rate increased again. We could be near the end and on our way to a better economy. However high Fed Rates translate to higher mortgage rates. Something else to thing about.

~~~~~~~~

The January jobs report removed any immediate concerns about a weakening labor market as the economy added 353,000 jobs. In addition, the December figure was revised up to 278,000, bringing the three-month average to 289,000 a month. While this is certainly well above a pace that is sustainable, it is worth remembering that the economy added 482,000 jobs last January, a figure that was initially reported as 517,000. Wage growth also appears to have picked up, with the average hourly wage increasing at a 5.4 percent annual rate over the last three months.

The unemployment rate remained unchanged at 3.7 percent, the 24th consecutive month where the unemployment rate has been below 4.0 percent. The employment-to-population ratio edged up by 0.1 percentage point, as the household survey reported an increase in employment of 239,000, removing the effect of new population controls.

Hours and Productivity

We saw extraordinarily rapid productivity growth over the last three quarters of 2023, with an average growth rate over this period of 3.9 percent. While there is no way that productivity will continue to grow at this pace, three strong quarters do raise the serious possibility that we are on a stronger growth path.

Despite the jump in employment in January, the index of aggregate hours actually fell by 0.3 percent, as the length of the average workweek declined by 0.2 hours. This follows a drop of 0.1 percent in December.

There was also a decline in the number of people reported as self-employed, with a rise in the number of incorporated self-employed (not seasonally adjusted) of 19,000 more than offset by a 240,000 decline in the number of unincorporated self-employed. It is too early to get much sense of first-quarter productivity, but even a modest uptick from the 1.6 percent rate in the five years prior to the pandemic should go far towards alleviating concerns about inflation.

Wage Growth Accelerates

The 5.4 percent annualized rate of wage growth over the last three months is likely faster than what can be sustained without a pickup in inflation. It seems to have been broadly spread across sectors. The pace of overall wage growth was slightly faster than the 5.1 percent rate for production and non-supervisory workers, reversing the pattern we saw earlier in the recovery.

This rise is at odds with the slowing of wage and compensation growth in the Employment Cost Index, which showed an annual rate of growth of just 3.6 percent in the 4th quarter. There are two points worth keeping in mind in considering the reported jump in earnings in January. First, we had extraordinary data reported for January last year as well, with subsequent months showing more moderation. The other point is that we should expect wages to outpace inflation, by more than productivity, for at least some period of time, if workers are to reverse the shift to profits that occurred during the pandemic.

Job Growth is Again Broadly Based

The November employment report showed that, ignoring the impact of the return of striking autoworkers, the job growth for the month could be completely attributed to three sectors: health, restaurants, and government. That raised concerns about the durability of the recovery. With the strong January job growth and the upward revisions to the December data, there is no longer any basis for these concerns.

The healthcare sector was again a leading job gainer, adding 70,300 jobs. The professional and technical services sector, a source of high-paying jobs, added 41,900 after a gain of 35,000 in December. Retail added 45,200 jobs in January. This growth is likely in part a seasonal adjustment issue. The sector reportedly lost 42,900 jobs in November. This loss could be explained by reduced seasonal hiring for the holidays. That is now being offset by less-than-normal layoffs in January. Restaurants actually lost 2,400 jobs in the month.

The government sector added 36,000 jobs, while the federal, state, and local levels added 11,000, 10,000, and 15,000 jobs, respectively. Construction added 11,000 jobs, with both residential and non-residential construction showing modest gains.

Manufacturing added 23,000 jobs in January. This is somewhat surprising. Job growth in the sector has been weak all year, with the sector adding just 14,000 jobs between January and December. With a number of surveys showing weakening employment and output in the sector, it seemed likely the sector would show some job loss last month. Interestingly, most of the gain was due to a rise in employment of 19,000 in non-durable manufacturing. This sector had lost 53,000 jobs between January and December.

Population Controls and Benchmark Revisions Fail to Close Gap Between Household and Establishment Surveys

The data from December showed a gain of 2,697,000 jobs over the prior year in the establishment survey compared with an increase in employment in the household survey of just 1,883,000, leaving a gap of more than 800,000. It turned out that the new population controls included with the January data lowered employment growth by even more than the benchmark adjustments to the establishment survey.

With the new population controls, the household survey now shows an increase in employment of 1,580,000 from January of 2023. The benchmark revision to the establishment survey lowered the pace of job growth so it now shows a gain of 2,930,000 from January of 2022, leaving a gap of 1,350,000. (Little of this gap can be explained by differences in concept.)

The establishment survey is far larger than the household survey, so it is generally more reliable. Also, if we think the slower pace of employment growth in the household survey is closer to the mark, then productivity growth is really going through the roof.

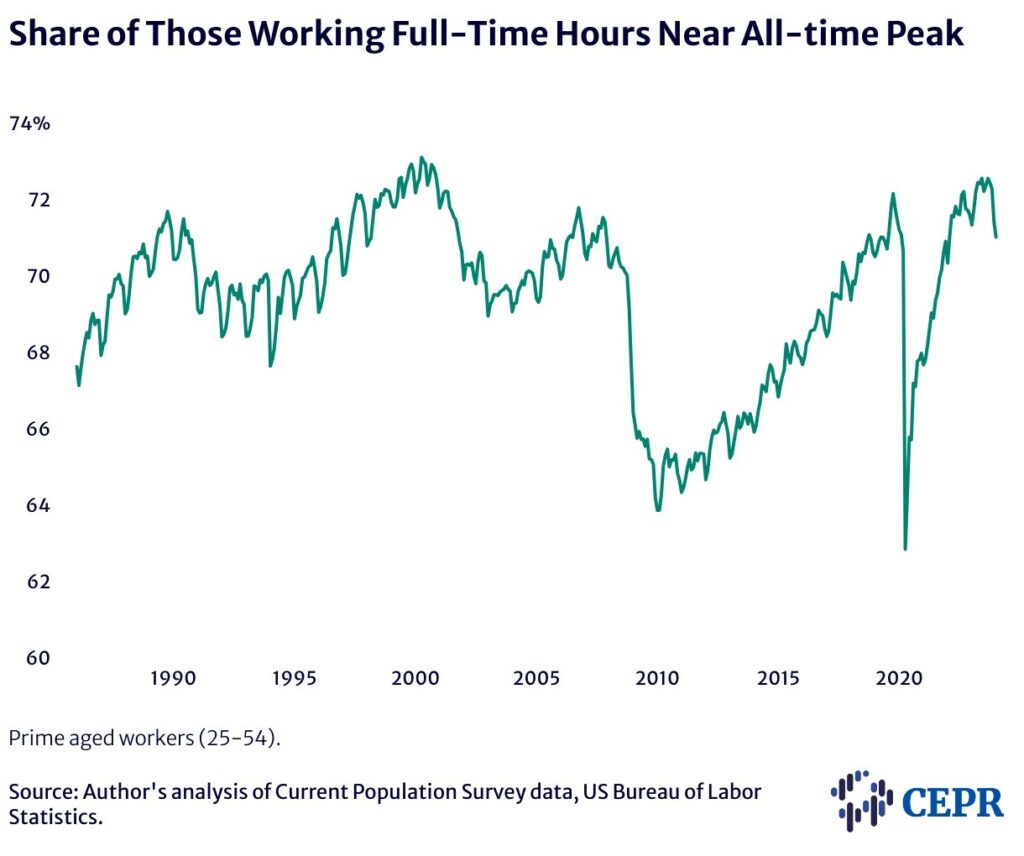

Modest Gains in Prime Age Employment

There was a modest increase in the prime age (ages 25 to 54) employment rate, with a rise of 0.2 percentage points to 80.6 percent. This tied the pre-pandemic peak but is still 0.3 pp below the peak hit from last year.

For men, the increase of 0.1 pp to 86.2% still left the level 0.5 pp below its pre-pandemic peak. The 0.2 pp rise to 75.0% for women is above pre-pandemic peak, but 0.3 pp below all-time high hit last fall.

Overall Picture, Solid Job Growth, but More Concerns on Inflation

The January jobs report should eliminate any concerns about an imminent recession, however, it will lead to renewed fears of inflation. We should remember that the extraordinary job growth reported for January of last year proved to be anomalous, as it did not continue into subsequent months. We also don’t see anything remotely comparable in the household data or other series like the JOLTS data, the ECI, or weekly unemployment claims, which have shown a modest uptick. And, even low-wage sectors like nursing homes and childcare centers are adding jobs at a healthy pace.

We should take the January jobs numbers as evidence that the labor market remains strong but hold off panicking about inflation getting reignited.