Scenes from the January jobs report: revisions changed the picture in the Establishment Survey – by New Deal democrat Last Friday’s jobs report contained a number of annual revisions which change what the trend line for the last year looks like. Particularly the extent to which there has been continued deceleration, or even a downturn, in a number of significant statistics in the Establishment Survey. In the below graphs, the original numbers are in blue, the revised numbers in red. First, in December the YoY% change in jobs created had trended down to +1.7%. With revisions, that increased to 2.0%, and in January it was 1.9%. In the past 6 months, to the extent there has been further deceleration, it has only been from July’s 2.1%:

Topics:

NewDealdemocrat considers the following as important: Establishment Survey, Hot Topics, January 2024, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Scenes from the January jobs report: revisions changed the picture in the Establishment Survey

– by New Deal democrat

Last Friday’s jobs report contained a number of annual revisions which change what the trend line for the last year looks like. Particularly the extent to which there has been continued deceleration, or even a downturn, in a number of significant statistics in the Establishment Survey.

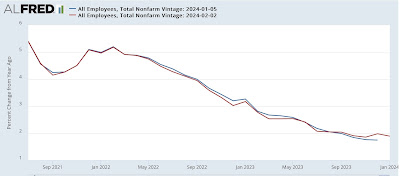

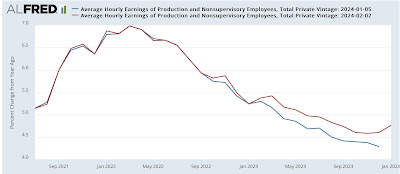

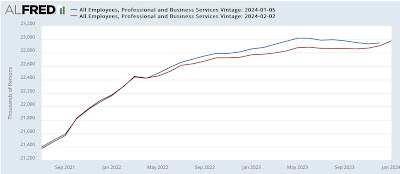

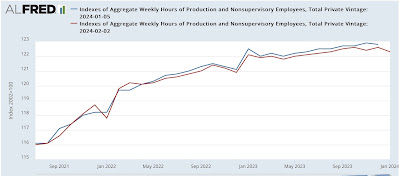

In the below graphs, the original numbers are in blue, the revised numbers in red.

First, in December the YoY% change in jobs created had trended down to +1.7%. With revisions, that increased to 2.0%, and in January it was 1.9%. In the past 6 months, to the extent there has been further deceleration, it has only been from July’s 2.1%:

A similar increase happened to average hourly earnings for nonsupervisory workers. In December the YoY% change was reported as 4.3%. With revisions, it became 4.6%. January saw an increase to 4.8%, almost equal to the YoY% change last August:

A particular weak spot in job creation has been in the higher paying sector of professional and business employment. This had shown an outright decline ever since last spring. There were downward revisions for the earlier months of 2023, and a renewed uptrend in the last two months instead:

While YoY job creation in this sector is still a relatively meager 0.9% (not shown), it is not so poor as the 0.5% which in the past had only happened during recessions.

The revisions weren’t all positive. Aggregate hours of nonsupervisory workers was revised downward for the past 20 months:

Aggregate hours as revised are no better now than they were last August.

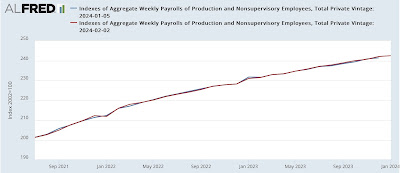

But the combination of higher hourly pay and fewer hours meant there was no effect on aggregate payrolls for nonsupervisory workers:

Since this last measure – aggregate payrolls – adjusted for inflation has not changed, the most important coincident indicator of expansion vs. recession remains quite positive.