Renewables 2023, Analysis and forecast to 2028. IEA, Paris Executive Summary I did this before with the IEA. Sent the IEA a few emails establishing what Angry Bear could and could not use. Attributing the analysis I have posted here was one of the requirements. With their permission, I can bring to Angry Bear much of what is going on in the globally in the area of energy. They asked that I do not report on oil as companies pay for the reports. This looks like a long read. It is not. It is broken up by spaced paragraphs and also charts and graphs. I believe Angry Bear readers as well as others might find this interesting. Note how the IEA is talking about improvements in renewables. Still a long way to go. China is moving forward faster

Topics:

Angry Bear considers the following as important: climate change, IEA, Renewables 2023, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Renewables 2023, Analysis and forecast to 2028.

IEA, Paris Executive Summary

I did this before with the IEA. Sent the IEA a few emails establishing what Angry Bear could and could not use. Attributing the analysis I have posted here was one of the requirements. With their permission, I can bring to Angry Bear much of what is going on in the globally in the area of energy. They asked that I do not report on oil as companies pay for the reports.

This looks like a long read. It is not. It is broken up by spaced paragraphs and also charts and graphs. I believe Angry Bear readers as well as others might find this interesting.

Note how the IEA is talking about improvements in renewables. Still a long way to go. China is moving forward faster than western nations. This is a more positive report than in the past. Perhaps, you have a different belief or opinion?

2023 saw a step change in renewable capacity additions, driven by China’s solar PV market

Global annual renewable capacity additions increased by almost 50% to nearly 510 gigawatts (GW) in 2023, the fastest growth rate in the past two decades. This is the 22nd year in a row that renewable capacity additions set a new record. While the increases in renewable capacity in Europe, the United States and Brazil hit all-time highs, China’s acceleration was extraordinary. In 2023, China commissioned as much solar PV as the entire world did in 2022, while its wind additions also grew by 66% year-on-year. Globally, solar PV alone accounted for three-quarters of renewable capacity additions worldwide.

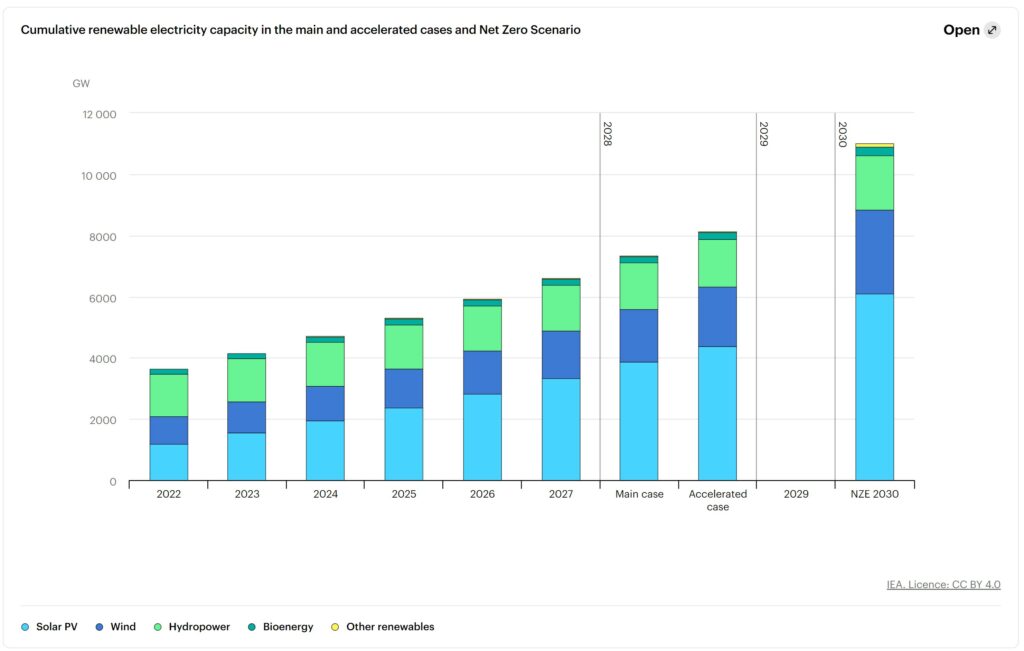

Achieving the COP28 target of tripling global renewable capacity by 2030 hinges on policy implementation

Prior to the COP28 climate change conference in Dubai, the International Energy Agency (IEA) urged governments to support five pillars for action by 2030, among them the goal of tripling global renewable power capacity. Several of the IEA priorities were reflected in the Global Stocktake text agreed by the 198 governments at COP28, including the goals of tripling renewables and doubling the annual rate of energy efficiency improvements every year to 2030. Tripling global renewable capacity in the power sector from 2022 levels by 2030 would take it above 11 000 GW, in line with IEA’s Net Zero Emissions by 2050 (NZE) Scenario.

Under existing policies and market conditions, global renewable capacity is forecast to reach 7 300 GW by 2028. This growth trajectory would see global capacity increase to 2.5 times its current level by 2030, falling short of the tripling goal. Governments can close the gap to reach over 11 000 GW by 2030 by overcoming current challenges and implementing existing policies more quickly. These challenges fall into four main categories and differ by country:

1) policy uncertainties and delayed policy responses to the new macroeconomic environment; 2) insufficient investment in grid infrastructure preventing faster expansion of renewables;

3) cumbersome administrative barriers and permitting procedures and social acceptance issues; and 4) insufficient financing in emerging and developing economies.

This report’s accelerated case shows the addressing of those challenges can lead to almost 21% higher growth of renewables, pushing the world towards being on track to meet the global tripling pledge.

What is needed to reach the collective target to triple renewables by 2030 varies significantly by country and region. G20 countries account for almost 90% of global renewable power capacity today. In the accelerated case, which assumes enhanced implementation of existing policies and targets, the G20 could triple their collective installed capacity by 2030. As such, they have the potential to contribute significantly to tripling renewables globally. To achieve the global goal, the rate of new installations needs to accelerate in other countries too. This includes many emerging and developing economies outside the G20, some of which do not have renewable targets and/or supportive policies today.

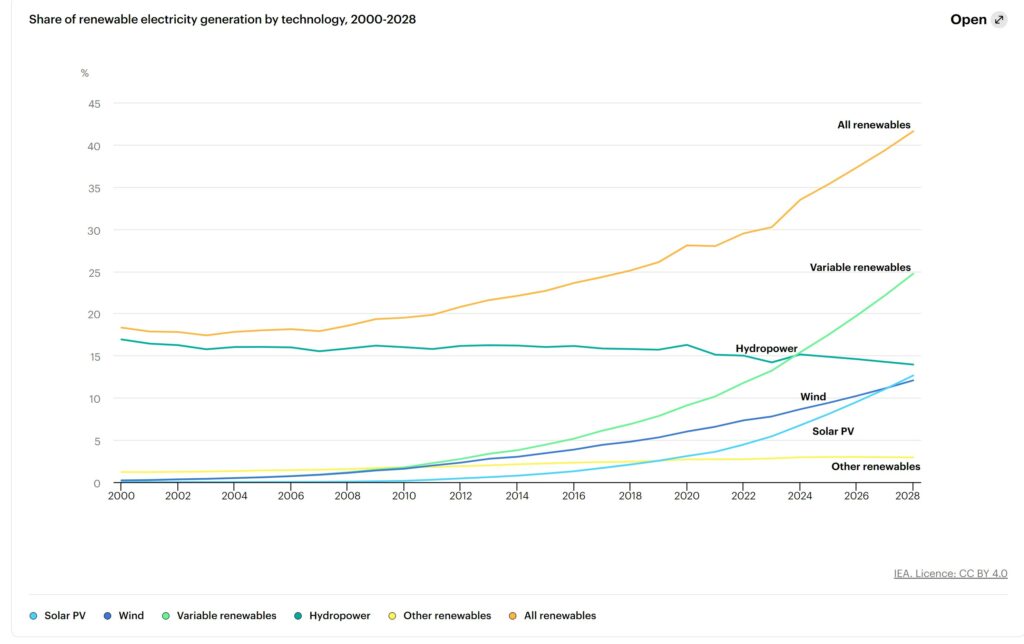

The global power mix will be transformed by 2028

The world is on course to add more renewable capacity in the next five years than has been installed since the first commercial renewable energy power plant was built more than 100 years ago. In the main case forecast in this report, almost 3 700 GW of new renewable capacity comes online over the 2023‑2028 period, driven by supportive policies in more than 130 countries. Solar PV and wind will account for 95% of global renewable expansion, benefiting from lower generation costs than both fossil and non‑fossil fuel alternatives.

Over the coming five years, several renewable energy milestones are expected to be achieved:

- In 2024, wind and solar PV together generate more electricity than hydropower.

- In 2025, renewables surpass coal to become the largest source of electricity generation.

- Wind and solar PV each surpass nuclear electricity generation in 2025 and 2026 respectively.

- In 2028, renewable energy sources account for over 42% of global electricity generation, with the share of wind and solar PV doubling to 25%.

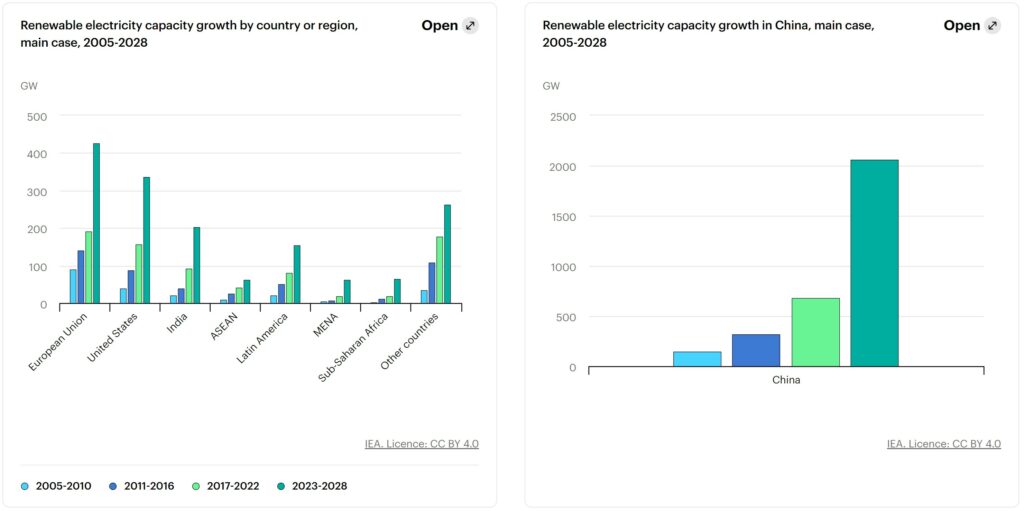

China is the world’s renewables powerhouse

China accounts for almost 60% of new renewable capacity expected to become operational globally by 2028. Despite the phasing out of national subsidies in 2020 and 2021, deployment of onshore wind and solar PV in China is accelerating, driven by the technologies’ economic attractiveness as well as supportive policy environments providing long-term contracts. Our forecast shows that China is expected to reach its national 2030 target for wind and solar PV installations this year, six years ahead of schedule. China’s role is critical in reaching the global goal of tripling renewables because the country is expected to install more than half of the new capacity required globally by 2030. At the end of the forecast period, almost half of China’s electricity generation will come from renewable energy sources.

The US, the EU, India and Brazil remain bright spots for onshore wind and solar PV growth

Solar PV and onshore wind additions through 2028 is expected to more than double in the United States, the European Union, India and Brazil compared with the last five years. Supportive policy environments and the improving economic attractiveness of solar PV and onshore wind are the primary drivers behind this acceleration. In the European Union and Brazil, growth in rooftop solar PV is expected to outpace large-scale plants as residential and commercial consumers seek to reduce their electricity bills amid higher prices. In the United States, the Inflation Reduction Act has acted as a catalyst for accelerated additions despite supply chain issues and trade concerns in the near term. In India, an expedited auction schedule for utility-scale onshore wind and solar PV along with improved financial health of distribution companies is expected to deliver accelerated growth.

Renewable energy expansion also starts accelerating in other regions of the world. Notably in the Middle East and North Africa and owing mostly to policy incentives that take advantage of the cost-competitiveness of solar PV and onshore wind power. Although renewable capacity growth picks up in sub‑Saharan Africa, the region still underperforms considering its resource potential and electrification needs.

Solar PV prices plummet amid growing supply glut

In 2023, spot prices for solar PV modules declined by almost 50% year-on-year, with manufacturing capacity reaching three times 2021 levels. The current manufacturing capacity under construction indicates that the global supply of solar PV will reach 1 100 GW at the end of 2024, with potential output expected to be three times the current forecast for demand. Despite unprecedented PV manufacturing expansion in the United States and India driven by policy support, China is expected to maintain its 80‑95% share of global supply chains (depending on the manufacturing segment). Although developing domestic PV manufacturing will increase the security of supply and bring economic benefits to local communities, replacing imports with more expensive production in the United States, India and the European Union will increase the cost of overall PV deployment in these markets.

Onshore wind and solar PV are cheaper than both new and existing fossil fuel plants

In 2023, an estimated 96% of newly installed, utility-scale solar PV and onshore wind capacity had lower generation costs than new coal and natural gas plants. In addition, three-quarters of new wind and solar PV plants offered cheaper power than existing fossil fuel facilities. Wind and solar PV systems will become more cost-competitive during the forecast period. Despite the increasing contribution needs for flexibility and reliability to integrate variable renewables, the overall competitiveness of onshore wind and solar PV changes only slightly by 2028 in Europe, China, India and the United States.

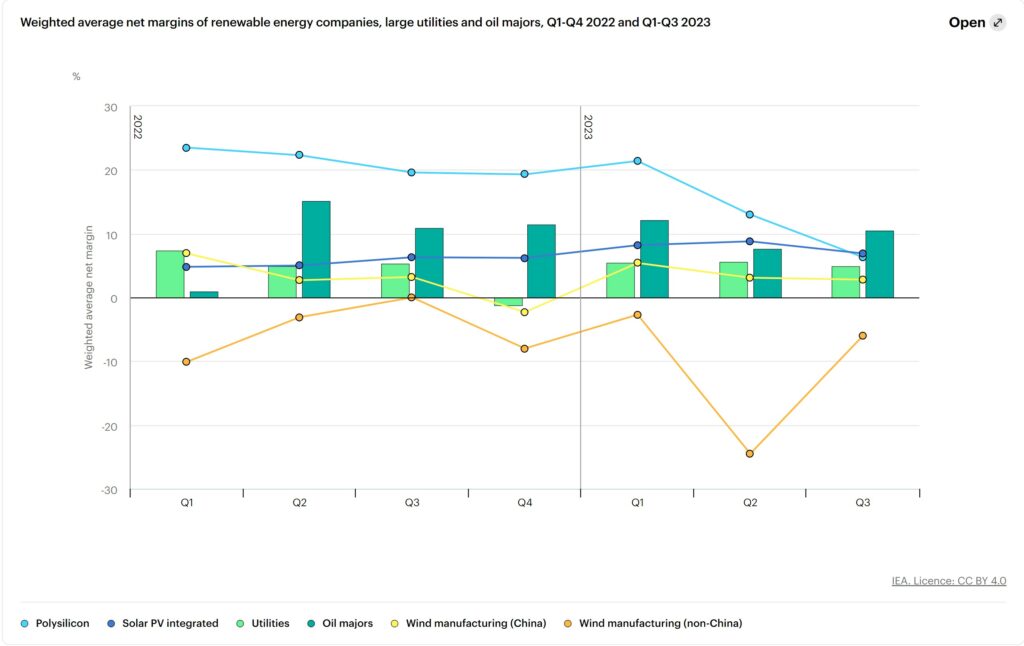

The new macroeconomic environment presents further challenges that policy makers need to address

In 2023, new renewable energy capacity financed in advanced economies was exposed to higher base interest rates than in China and the global average for the first time. Since 2022, central bank base interest rates have increased from below 1% to almost 5%. In emerging and developing economies, renewables developers have been exposed to higher interest rates since 2021, resulting in higher costs hampering faster expansion of renewables.

The implications of this new macroeconomic environment are manifold for both governments and industry. First, inflation has increased equipment costs for onshore and offshore wind and partly for solar PV (excluding module costs). Second, higher interest rates are increasing the financing costs of capital-intensive variable renewable technologies. Third, policy has been relatively slow to adjust to the new macroeconomic environment due in part to expectations that cost reductions would continue together with permitting challenges. This has left several auctions in advanced economies undersubscribed, particularly in Europe. Additionally, some developers whose power purchase contracts were signed prior to these macroeconomic changes have had to cancel their projects. Efforts to improve auction design and contract indexation methodologies are needed to resolve these challenges and unlock additional wind and solar PV deployment.

The renewable energy industry, particularly wind, is grappling with macroeconomic challenges affecting its financial health – despite a history of financial resilience. The wind industry has experienced a significant decline in market value as European and North American wind turbine manufacturers have seen negative net margins for seven consecutive quarters due to volatile demand, limited raw material access, economic challenges, and rising interest rates. To address these issues, the European Union launched a Wind Power Action Plan in October 2023, aiming to enhance competitiveness, improve auction design, boost clean technology investment, streamline permitting, and ensure fair competition. Chinese wind turbine manufacturers, benefiting from strong domestic demand and vertical integration, remain relatively stable amid global challenges.

The forecast for wind capacity additions is less optimistic outside China, especially for offshore

The wind industry, especially in Europe and North America is facing challenges due to a combination of ongoing supply chain disruptions, higher costs and long permitting timelines. As a result of these challenges, the forecast for onshore wind outside of China has been revised downwards as overall project development has been slower than expected.

Offshore wind has been hit hardest by the new macroeconomic environment, with its expansion through 2028 revised down by 15% outside China. The challenges facing the industry particularly affect offshore wind, with investment costs today more than 20% higher than only a few years ago. In 2023, developers have cancelled or postponed 15 GW of offshore wind projects in the United States and the United Kingdom. For some developers, pricing for previously awarded capacity does not reflect the increased costs facing project development today, which reduces project bankability.

Faster deployment of variable renewables increases integration and infrastructure challenges

The share of solar PV and wind in global electricity generation is forecast to double to 25% in 2028 in our main case. This rapid expansion in the next five years will have implications for power systems worldwide. In the European Union, annual variable renewables penetration in 2028 is expected to reach more than 50% in seven countries, with Denmark having around 90% of wind and solar PV in its electricity system by that time. Although European Union interconnections help integrate solar PV and wind generation, grid bottlenecks will pose significant challenges and lead to increased curtailment in many countries as grid expansion cannot keep pace with accelerated installation of variable renewables.

Current hydrogen plans and implementation don’t match

Renewable power capacity dedicated to hydrogen-based fuel production is forecast to grow by 45 GW between 2023 and 2028, representing only an estimated 7% of announced project capacity for the period. China, Saudi Arabia and the United States account for more than 75% of renewable capacity for hydrogen production by 2028. Despite announcements of new projects and pipelines, the progress in planned projects has been slow. We have revised down our forecasts for all regions except China. The main reason is the slow pace of bringing planned projects to final investment decisions due to a lack of off‑takers and the impact of higher prices on production costs. The development of an international hydrogen market is a key uncertainty affecting the forecast, particularly for markets that have limited domestic demand for hydrogen.

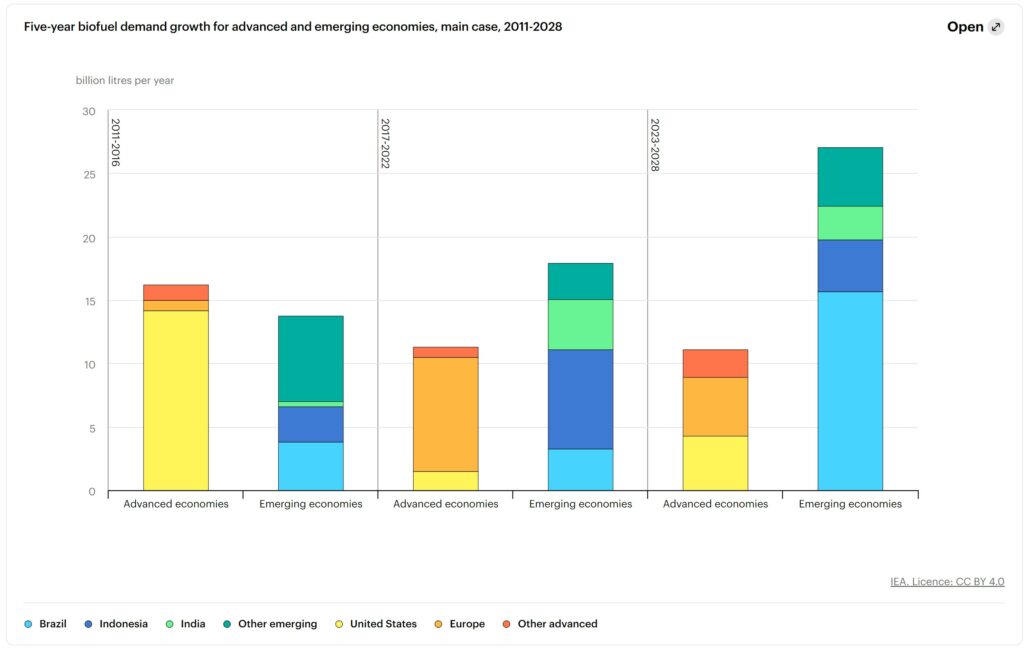

Biofuel deployment is accelerating and diversifying more into renewable diesel and biojet fuel

Emerging economies, led by Brazil, dominate global biofuel expansion, which is set to grow 30% faster than over the last five years. Supported by robust biofuel policies, increasing transport fuel demand and abundant feedstock potential, emerging economies are forecast to drive 70% of global biofuel demand growth over the forecast period. Brazil alone accounts for 40% of biofuel expansion to 2028. Stronger policies are the primary driver of this growth as governments expand efforts to provide affordable, secure and low-emission energy supplies. Biofuels used in the road transport sector remain the primary source of new supply, accounting for nearly 90% of the expansion.

Electric vehicles (EVs) and biofuels are proving to be a powerful complementary combination for reducing oil demand. Globally, biofuels and renewable electricity used in EVs are forecast to offset 4 million barrels of oil‑equivalent per day by 2028, which is more than 7% of forecast oil demand for transport. Biofuels remain the dominant pathway for avoiding oil demand in the diesel and jet fuel segments. EVs outpace biofuels in the gasoline segment, especially in the United States, Europe and China.

Aligning biofuels with a net zero pathway requires a huge increase in the pace of deployment

This report’s main case forecast is not in line with the near tripling of biofuels demand by 2030 seen in the IEA’s Net Zero Emissions by 2050 (NZE) Scenario. In the aviation sector for instance, the Net Zero Scenario would require 8% of fuel supply coming from biojet fuel by 2030, while existing policies in this forecast will only bring biojet fuel’s share to 1% by 2028. Bridging this gap requires new and stronger policies, as well as diversification of feedstocks.

Much faster biofuel deployment is possible through new policies and addressing supply chain challenges. In this report’s accelerated case, biofuel supply growth is nearly triple that of the main case, closing the gap with the Net Zero Scenario by nearly 40%. Nearly half of this additional growth, almost 30 billion litres, is driven by strengthened policies in existing markets such as the United States, Europe and India. Another 20 billion litres comes mainly from biodiesel in India and ethanol in Indonesia. Biojet fuel offers a third growth avenue, expanding to cover nearly 3.5% of global aviation fuels, up from 1% in the main case. Fuels made from waste and residues also grow four times faster in the accelerated case.

Renewable heat accelerates amid high energy prices and policy momentum – but not enough to curb emissions

Modern renewable heat consumption expands by 40% globally during the outlook period, rising from 13% to 17% of total heat consumption. These developments come predominantly from the growing reliance on electricity for process heat – notably with the adoption of heat pumps in non‑energy‑intensive industries – and the deployment of electric heat pumps and boilers in buildings, increasingly powered by renewable electricity. China, the European Union and the United States lead these trends, owing to supportive policy environments; updated targets in the European Union and China; strong financial incentives in many markets; the adoption of renewable heat obligations; and fossil fuel bans in the buildings sector.

However, the trends to 2028 are still largely insufficient to tackle the use of fossil fuels for heat and put the world on track to meet Paris Agreement goals. Without stronger policy action, the global heat sector alone between 2023 and 2028 could consume more than one‑fifth of the remaining carbon budget for a pathway aligned with limiting global warming to 1.5°C. Global renewable heat consumption would have to rise 2.2 times as quickly and be combined with wide-scale demand-side measures and much larger energy and material efficiency improvements to align with the NZE Scenario.

World Energy Outlook 2023, windows.net. IEA