By David Zetland The one-handed economist Benefit-cost accounting (BCA) began with a simple comparison of monetary benefits and costs, e.g., should I invest 0 in exchange for a return of per year. Then people wanted to compare more abstract values, such as the benefit of a vacation or sandwich or education against the costs of those goods. In those cases, the benefits are somewhat subjective — depending on the person, timing, etc. — but economists have used various techniques to try to quantify the benefits. The most obvious is “revealed preference,” which looks at decisions as an indicator of value. Thus, we assume that anyone who buys the sandwich is receiving adequate benefits (happiness, calories) compared to the the cost. This

Topics:

Angry Bear considers the following as important: monetary benefits and costs, politics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

by David Zetland

The one-handed economist

Benefit-cost accounting (BCA) began with a simple comparison of monetary benefits and costs, e.g., should I invest $100 in exchange for a return of $10 per year.

Then people wanted to compare more abstract values, such as the benefit of a vacation or sandwich or education against the costs of those goods. In those cases, the benefits are somewhat subjective — depending on the person, timing, etc. — but economists have used various techniques to try to quantify the benefits. The most obvious is “revealed preference,” which looks at decisions as an indicator of value. Thus, we assume that anyone who buys the sandwich is receiving adequate benefits (happiness, calories) compared to the the cost. This method is not very precise for individual decisions, but it is more accurate with a lot of data on frequent purchases in competitive markets. So it’s better for sandwiches or houses, but not so much for antiques, a cooking course or even an education (we rarely do two university bachelor’s degrees).

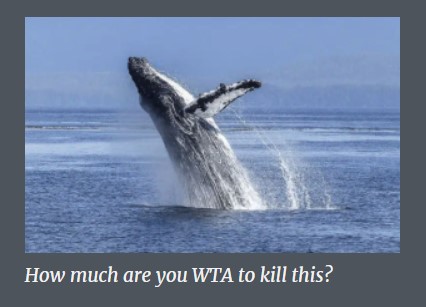

So there are issues of subjectivity. And they get worse, the more abstract the benefits and costs — the value of a whale for example.

But we need to know the value of whales, or a human life, or a cure for HIV/AIDS, so economists have gotten more and more creative.

(Can we just ignore exact values and say “it’s worth infinite”? Not when it comes to making choices, i.e., how many whales are we willing to kill if that means saving a human life… or how many humans are we willing to let die to save a whale. More on this in a moment.)

The “science” of calculating the value of a statistical [human] life (VSL) is theoretically elegant, but controversial — most obviously because it’s based on wages, which implies, for example, that one American life (gdp/capita) is “worth” ten Peruvian lives.*

But, back to whales. There are two main methods of assessing value, both based on asking people questions:

Willingness to pay (WTP): “How much will you pay to save a whale from death?”

Willingness to accept (WTA): “How much can I pay you to kill a whale?”

Although these $$ figures should be the same, they are vastly different in practice, due to budgetary limits (money in your pocket), endowment effects (is the whale mine), abstraction (this whale or a “representative” whale?), etc.

Which brings me to ducks…

So there’s an old joke among economists:

Land developer: “Can you give me the value of this wetland, so I can decide if I should build a shopping mall here?”

Economic consultant: “Sure.”

LD: “Great, how much will you charge?”

EC: “Depends on what answer you want.”

So, the point here is that there’s a lot of subjectivity in calculating the non-market values of benefits or costs. That’s why you often see economists on both sides of a dispute, each with a “scientific” estimate of value that is vastly higher or lower than the others. That’s not because values are so different from the same process; it’s because there are different processes of arriving at values — none of which is more legitimate than the other!**

Now to ducks.

If the EC wants to stop the LD from building the shopping mall, then they need merely to identify some ducks (say 100), assign a WTA value of $50,000 per duck, and say “whelp, the costs of destroying that habitat and thus those ducks is so high that your project fails the CBA.”

OTOH, the EC can say “ducks are like chickens, and chickens cost around $2 each, so you need to send $200 to Ducks Unlimited so they can save some ducks elsewhere. Bring on the machines.”

Bottom line: Economists with two hands can make or break your project by ignoring or counting VSDs. Is that fair? No. But it is “scientific” so plan accordingly.

* Back in the times of paper airline tickets, this tradeoff was spelled out, in terms of compensation for death on flights in/to/from the US, which was a multiple of compensation for flights that did not have a US-leg. That may have also reflected the influence of lawyers. I can’t find a good link, but here’s a start.

**This is no trivial point. The “social cost of carbon” is one of the most relevant, yet debated (often for nefarious reasons) values out there. I’d say that the future of our civilization depends on getting it right. Sadly, we are getting it wrong because a lot of people want to pretend that emissions do not matter… while they are living large.