December real retail sales: the good economic news keeps on coming – by New Deal democrat The good economic news kept coming with this morning’s retail sales report for December. Remember that this is one of my favorite indicators because, adjusted for population, it is a fairly good long leading indicator, and on a short term basis has a consistent record of leading the trend in employment. Nominally retail spending increased 0.6% for the month. More importantly, after adjusting for inflation, which rose 0.3%, real retail spending rounded to up 0.2%. This continued a nearly perfect record of monthly increases that started last March, and is 2.2% above its post-pandemic stimulus low in February 2022. The only negative is that it does remain

Topics:

NewDealdemocrat considers the following as important: Hot Topics, January 2024, Retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

December real retail sales: the good economic news keeps on coming

– by New Deal democrat

The good economic news kept coming with this morning’s retail sales report for December. Remember that this is one of my favorite indicators because, adjusted for population, it is a fairly good long leading indicator, and on a short term basis has a consistent record of leading the trend in employment.

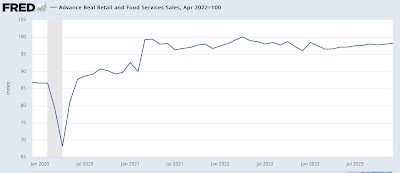

Nominally retail spending increased 0.6% for the month. More importantly, after adjusting for inflation, which rose 0.3%, real retail spending rounded to up 0.2%. This continued a nearly perfect record of monthly increases that started last March, and is 2.2% above its post-pandemic stimulus low in February 2022. The only negative is that it does remain -1.9% below its post-pandemic peak in April 2022:

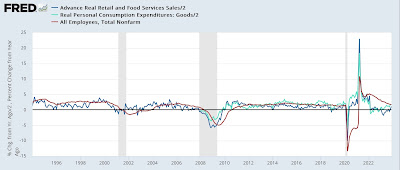

The best way to visualize retail sales’ lead over employment (red in the graph below) is YoY (blue, /2 for scale), shown for the past 30 years. I also show real personal consumption on goods since the turn of the Millennium (light blue), which has a similar record:

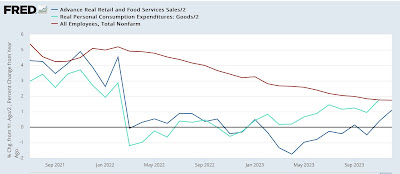

Here is the close-up since July 2022:

The good news here is that YoY comparisons of real retail sales continue to improve, now up 1.1%. Real personal consumption on goods has similarly improved, up 1.8% as of November. Since nonfarm payrolls were up 1.7% YoY, both consumption series suggest that any further deceleration in jobs gains will be slow, and it is possible we get the fabled “soft landing,” with job growth leveling out at this trend rate.

To reiterate: this was a good report.

Real retail sales mildly positive, but still suggest further deceleration in job gains, Angry Bear, by New Deal democrat