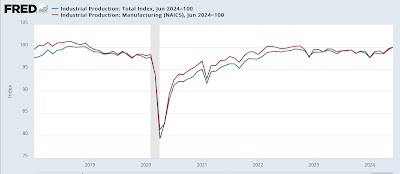

Industrial and manufacturing production close to 10 year+ highs in June – by New Deal democrat If the news in housing construction the other morning was cautionary, the news on manufacturing and industrial production was very good. Manufacturing production (red in the graph below) rose 0.4% in June, and is only 0.2% below its post-pandemic high in October 2022. It is also only 1.2% below its highest level since the Great Recession, which was set in September 2018. The news was even better for total industrial production (blue), which rose 0.6% in June to a new post-pandemic high, and is only 0.1% below its all-time high, also set in September 2018: In the past, industrial production has been the King of Coincident Indicators, since

Topics:

NewDealdemocrat considers the following as important: industrial production, manufacturing, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Joel Eissenberg writes Time for Senate Dems to stand up against Trump/Musk

Industrial and manufacturing production close to 10 year+ highs in June

– by New Deal democrat

If the news in housing construction the other morning was cautionary, the news on manufacturing and industrial production was very good.

Manufacturing production (red in the graph below) rose 0.4% in June, and is only 0.2% below its post-pandemic high in October 2022. It is also only 1.2% below its highest level since the Great Recession, which was set in September 2018.

The news was even better for total industrial production (blue), which rose 0.6% in June to a new post-pandemic high, and is only 0.1% below its all-time high, also set in September 2018:

In the past, industrial production has been the King of Coincident Indicators, since its peaks and troughs tended to coincide almost exactly with the onset and endings of recessions. That weighting has faded somewhat since the accession of China to the world trading system in 1999 an the wholesale flight of US manufacturing to Asia, generating several false recession signals, most notably in 2015-16. But it is still an important measure in the economy.

In other words, while several important leading indicators are getting close to yellow flag cautionary signals, or in one case (real retail spending) already there, this very important coincident indicator signals all clear for the present.